Table of contents

Table of contents- Troubled Waters: Panama Canal Disruption Presents a New Supply Chain Planning Dilemma

- The Panama Canal in figures

- What is the current status of the Panama Canal?

- The impact of climate change on supply chain operations

- Extreme weather events

- Increase in operating costs

- Tighter regulations

- Consequences of the Panama Canal delays on global supply chains

- Tips for dealing with the Panama Canal slowdown

- Panama canal disruption takeaways

Carrying over 14,000 shipping containers with a combined $270 billion in cargo annually, the Panama Canal is perhaps one of the most crucial pieces of the supply chain puzzle. But what happens when droughts dry up transits across this critical crossing point for global trade? In this blog, Manuel Yagüe, explores how businesses should respond to this latest supply chain crisis.

I have a great friend who lives in Panama. A year ago, we visited him and took the opportunity to see the Miraflores Locks section of the Panama Canal.

When we left these magnificent facilities, I thought that my relationship with the canal would end with my visit to the city, and that ships would continue to transit this marvellous feat of human engineering that links the Atlantic and Pacific oceans, avoiding millions of nautical miles, millions of litres of fuel and many days at sea for ships carrying goods.

However, in the last few weeks, this infrastructure has caused major disruption in the lives of everyone involved in the supply chain industry, due to the extreme drought conditions being experienced in the Central American country. Consequently, marine traffic is much less fluid than usual.

And so, we all need to consider the impact this situation is having on our supply chain operations, and think about how to manage the situation as efficiently and effectively as possible.

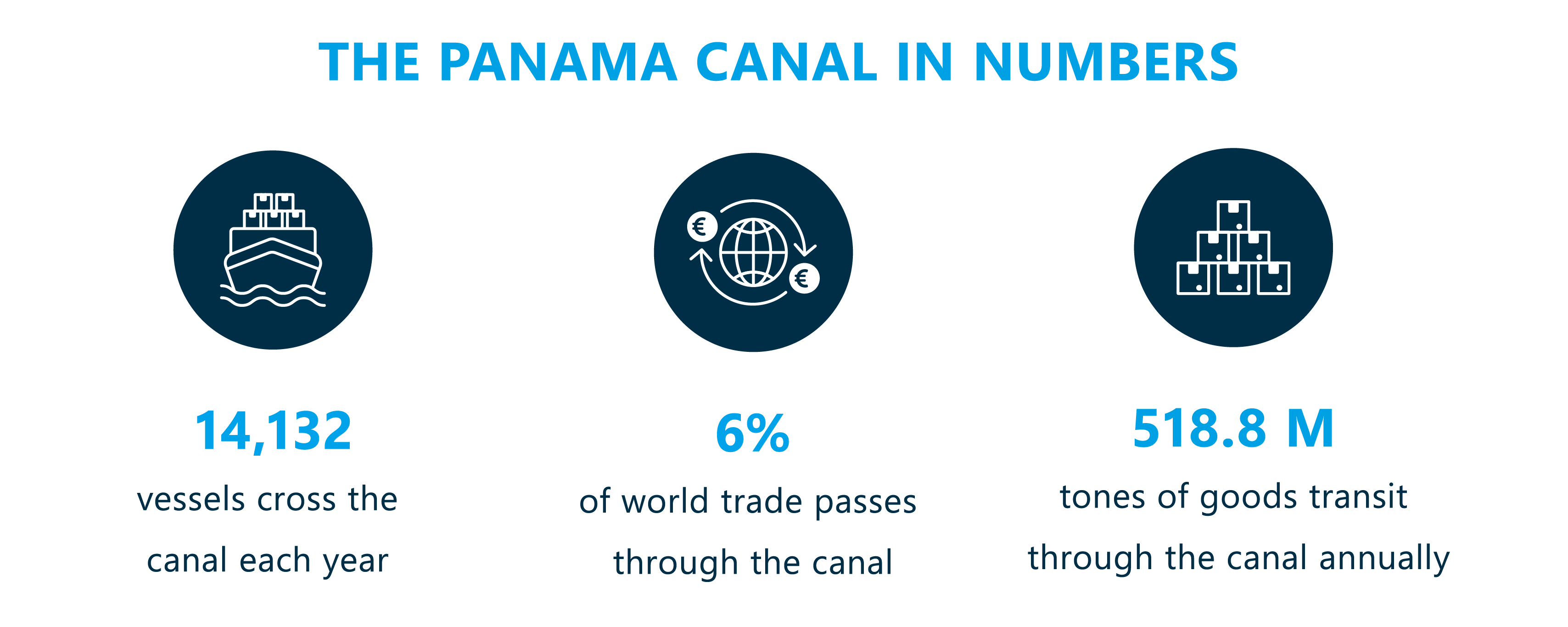

The Panama Canal in figures

Before delving into what is happening to the Panama Canal, and how it is affecting global freight transport, it is interesting to review some figures, which illustrate the scale of this infrastructure and its role in international trade.

- Despite numerous supply chain disruptions, the Panama Canal set a record for vessel traffic in its fiscal year 2022 (running from 1 October 2021 to 30 September 2022). This record activity translated into 14,239 vessels transiting the canal, which equates to 897 vessels more, year-on-year.

- Panama Canal revenues reached an all-time high of $3.028 billion.

- About 6% of world trade passes through the Panama Canal.

All these figures place the Panama Canal as one of the vital steps for the proper functioning of international trade and the global economy, along with other infrastructures such as the Suez Canal or routes such as the Straits of Hormuz and Malacca.

What is the current status of the Panama Canal?

Broadly speaking, the current situation in the Panama Canal is that marine traffic has slowed as a result of the drought in the country. Consequently, the daily traffic has decreased to just 32 vessels per day. As the traffic backs up either side of the canal, the delay has reached 22 days. This means that it now takes the same amount of time to go through the Panama Canal as it does to sail around the South American continent via the southern cone.

In recent weeks there has been a much higher backlog of ships than usual waiting to cross the channel in both directions. In fact, in August 2023, the waiting time to enter the canal was just over 11 days, whereas in the same month in 2022, it was approximately 3 days.

The impact of climate change on supply chain operations

Climate change is undoubtedly one of the greatest challenges of our time. It is a phenomenon that has the potential to alter absolutely everything. And the supply chain is clearly no exception. Here are some of the effects that climate change can have on the supply chain process.

Extreme weather events

This is the most obvious effect, and is at the root of the current situation in the Panama Canal. Rising global temperatures have led to an increase in extreme weather events, such as hurricanes, floods and drought. These can severely disrupt supply chain operations by damaging infrastructure such as roads, ports, warehouses and canals, and can delay or even damage shipments of goods.

Increase in operating costs

The need to adapt to extreme weather conditions leads to increased operational costs within the supply chain. This can include investments in climate-resilient infrastructure, more expensive insurance and additional expenses needed to ensure that operations continue smoothly during severe weather events.

Tighter regulations

Governments and international organisations are implementing stricter regulations related to sustainability and carbon emissions. Companies can be affected by these regulations, thereby requiring changes in the way they operate, and particularly in their supply chains.

Consequences of the Panama Canal delays on global supply chains

At this point you may be asking yourself, how does all this affect my own supply chain? Well, if you are a supply chain professional, you will be more aware than anyone else of the successive supply crises we have been suffering recently: the coronavirus pandemic, the Suez Canal bottleneck, the war in Ukraine, and now the slowdown in the Panama Canal.

They all have similar consequences on the supply chain. Here are some of them.

Just in case purchases are the order of the day

All of the above-mentioned disruptions have reinforced the Just in Case procurement model rather than the Just in Time model. In other words, many companies are overprovisioning in case of unexpected events. This strategy can go right or it can go wrong. I have friends who play roulette and sometimes they win… but you are certainly at the mercy of Lady Luck.

Beyond speculative purchases, previous crises have taught us the risk of these Just in Case purchases causing a damaging bullwhip effect. Regular market demand is transformed into waves, which leave the supplier unsure of what he is facing, and he ends up inflating his forecasts and, therefore, his supplies. The result of this is overstocking, which penalises inventories and often results in obsolete products.

Increased Lead Time

Increased delivery times are also a common consequence of supply chain disruptions. This is epitomised in the Panama Canal crisis, as ships are facing weeks of delay.

The longer it takes for a ship to pass through the channel, the longer the delivery time of the goods they are carrying. And when delivery times increase, so do cycle stock levels (“I have to order to cover a longer period of time”) and the level of safety stock (“I need to order more, because there is more chance of a delay”). In this way, we see that the stock, and the amount of money we invest in it, increases.

Widespread price increases

This supply problem inevitably leads to higher prices. And what happens if the value of goods rises? You need to invest more or reduce your stock levels so as not to increase your investment in working capital.

Continuing on with the inflation narrative, what is the natural action of governments and central banks to contain prices? Well, raising interest rates, of course … which also forces up the value of your inventory investment.

In the case of your not being in a position to increase investment in stock, the reduction of items in your inventory will often result in the following scenarios:

Forced reduction of references in the assortment

You reduce the number of items you offer in your assortment, and you stop stocking some items and begin working on a make-to-order basis. The famous phrase, “I don’t have it now, but I’ll order it for you and have it here in a few days”, is a product of this method of working to order.

Forced stock reduction for assortment products

Reducing the number of units you hold of your items may result in a lowering of the level of service you can offer your customers. However, if you sort your items from most important to least important – based on ABC analysis and reduce coverage of the less important ones, your customers will be less impacted by this measure.

Tips for dealing with the Panama Canal slowdown

From the reflections I have put forward in the case of phenomena such as the slowing down of the Panama Canal, we can draw some conclusions:

If possible, avoid stocking up Just in Case

Just in Case strategies can cause us to stock up on the wrong items, and result in a saturated warehouse that will end up with stock having to be liquidated through promotions.

Cover yourself against the bullwhip effect

You should prevent this distortion by modifying the recorded demand, or by removing abnormal demand periods from the historical series.

Review your supplier policy

Take into account the long lead times of certain suppliers, which cause inventories to grow disproportionately. Have you explored alternative suppliers? Are you able to reach agreements with them so that the supplier is the one who accumulates the stock near your facilities?

Inflation and high interest rates

Both of these phenomena increase the cost of working capital. Careful consideration should be given to ways of reducing this figure through strategic measures that do not impact the level of service to your customers.

But after all these reflections, I can’t help thinking: “I wish my Panama story had remained with the visit to my friend!”

Panama canal disruption takeaways

Panama Canal Disruption: The Panama Canal, a vital artery for global trade, is facing significant disruptions due to severe drought conditions in Panama. These disruptions are causing delays and challenges for supply chain operations.

Critical Role in Global Trade: The Panama Canal handles over 14,000 vessels annually, carrying goods worth $270 billion. It accounts for about 6% of world trade and plays a crucial role in international commerce.

Climate Change Impact: Climate change is a growing concern for supply chain operations. Extreme weather events, like the drought affecting the Panama Canal, can damage infrastructure, delay shipments, and increase operational costs.

Similar Supply Chain Crises: The Panama Canal disruptions are part of a series of recent supply chain crises, including the COVID-19 pandemic, the Suez Canal blockage, and the conflict in Ukraine. These events have led to a shift from “Just in Time” to “Just in Case” procurement models.

Bullwhip Effect: Overprovisioning in the “Just in Case” model can lead to the bullwhip effect, causing overstocking and obsolete products, impacting inventories and financial efficiency.

Increased Lead Time and Prices: Delays in the Panama Canal result in longer delivery times, increasing cycle stock levels and safety stock. This, in turn, leads to higher prices for goods.

Strategic Measures: To address these challenges, supply chain professionals are advised to reconsider overstocking, mitigate the bullwhip effect, review supplier policies to reduce lead times, and strategize ways to reduce working capital costs without compromising customer service.

Resilience in Uncertain Times: The disruptions in the Panama Canal highlight the need for businesses to adapt, plan for resilience, and navigate the complex interplay between climate change, supply chain operations, and global trade in an increasingly uncertain world.