Table of contents

Table of contents- Pharmaceutical Supply Chain: Optimizing Operations in the MEA Region

- Key challenges in pharmaceutical supply chain management

- The impact of formularies on the pharma Supply Chains in MEA

- Pharma Supply chain Strategy: Segmentation and Best Practices

- Key Takeaways for Optimizing Pharmaceutical Supply Chains in the MEA Region

- Looking for a Pharmaceutical Supply Chain Software?

- FAQs about Pharmaceutical Supply Chain Management

Overview

Optimizing the pharmaceutical supply chain in the MEA region requires segmenting products by value and demand volatility, as this diverse assortment, complex regulations and the impact of insurance formularies necessitate tailored inventory management and demand forecasting strategies to ensure the consistent availability of life-saving medicines.

Pharmaceutical companies play a crucial role in ensuring that life-saving medicines reach the people who need them most. Therefore, a reliable supply chain is essential to maintain the trust of customers and ensure the consistent availability of critical medications.

However, pharmaceutical supply chain management comes with significant challenges, as the industry operates in a highly regulated and complex environment. A well-managed pharmaceutic supply chain ensures that the right product reaches the right patient, in the right condition, at the right time.

Key challenges in pharmaceutical supply chain management

Active pharmaceutical ingredients (API) and product assortment management

To better understand the complexities of supply chain management in the pharmaceutical industry, it is essential to explore the unique characteristics of a pharma company’s product assortment.

Every medicine will have an Active Pharmaceutical Ingredient (API), which is the central component of the medicine that produces the required effect on the body to treat a condition.

A single API can be formulated into multiple products, leading to different items within a company’s portfolio that treat the same condition. For some patients or distribution channels, these products may be interchangeable. However, substitution isn’t always possible due to factors such as patient needs, regulatory restrictions, or insurance coverage.

As a result, pharmaceutical companies must establish precise business rules to manage substitutions and ensure compliance with legal and safety standards. Setting up these rules correctly is critical, not just for operational efficiency, but for patient safety.

Managing prescription and OTC products in the pharmaceutical supply chain

Another challenge pharma companies face is the division between prescription drugs and over-the-counter (OTC) products in their assortment.

| Prescription Medications | Over-the-counter (OTC) Products | |

|---|---|---|

| Regulatory Compliance | Stricter regulatory compliance required | Fewer regulatory restrictions |

| Documentation | Requires extensive documentation | Minimal documentation required |

| Storage Requirements | Stricter storage conditions | Less stringent storage requirements |

| Demand Patterns | Volatile demand, influenced by changes in medical guidelines | More predictable, often follows seasonal trends |

| Profit Margins | Typically yield higher margins | Lower margins compared to prescription medications |

| Inventory Management | Requires careful segmentation due to diverse assortment | Easier to manage but still requires segmentation |

The impact of formularies on the pharma Supply Chains in MEA

In the MEA region, insurance companies typically operate using formularies, which are lists of drugs that are covered or reimbursed based on cost-effectiveness assessments. These formularies play a crucial role in determining which medications are accessible to insured patients, directly influencing prescription and utilization patterns. If a drug is not included on a formulary, its demand may drop significantly as patients and healthcare providers often opt for alternative treatments that are covered.

Incorporating the formularies of the region’s largest insurance providers into demand planning can greatly enhance forecast accuracy and market responsiveness. When a medication is added to or removed from a formulary, it can trigger significant shifts in demand, impacting not only sales but also inventory management.

As such, regular monitoring of these formulary changes and adjusting sales forecasts accordingly is essential for optimizing inventory, avoiding overstock or shortages, and ensuring supply meets the actual market needs. By aligning forecasts with formulary updates, companies can better manage their distribution strategies and maintain a competitive edge.

Pharma Supply chain Strategy: Segmentation and Best Practices

The diverse assortment of pharmaceutical products necessitates a strategic segmentation approach, allowing companies to establish target service levels tailored to the unique characteristics of each product.

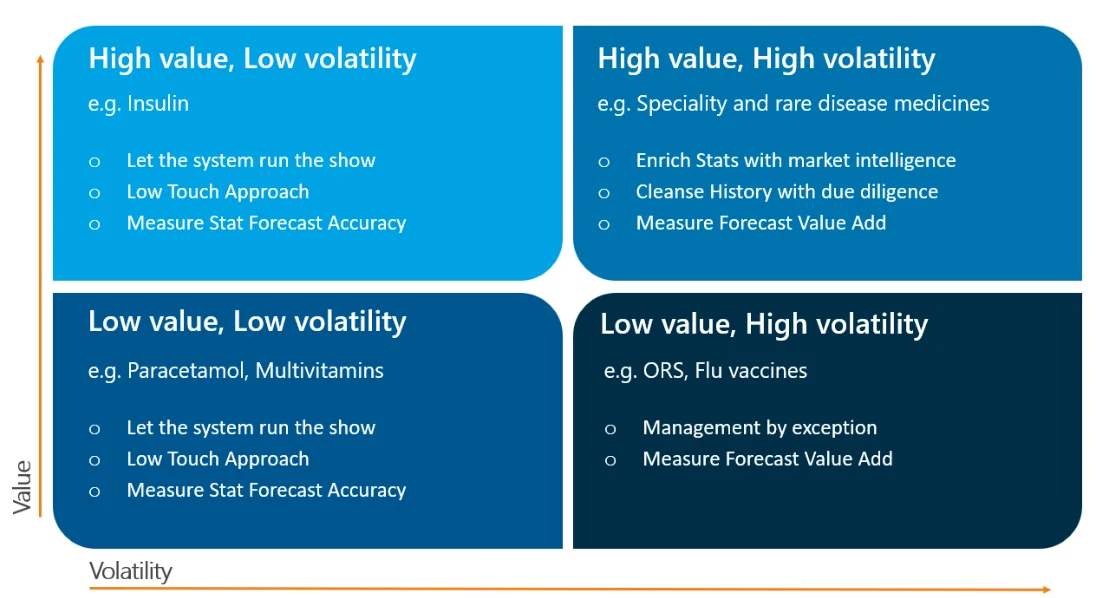

This segmentation can be mapped across two axes: demand volatility and sales value. By categorizing products accordingly, companies can prioritize their planning efforts and effectively manage service levels.

This can be better understood through the following examples:

Paracetamol

- Paracetamol is inexpensive and has steady demand.

- Typically available over-the-counter, with minimal fluctuations in demand..

- Due to the low volatility in demand, it allows for efficient stock management with minimal intervention.

- Given the low volatility, the safety stock required to account for demand uncertainty is relatively low.

- Thus, target service levels can be set at moderate to high levels without significantly increasing costs due to the low value of the item,

- This approach typically allows companies to fully automate, having a no-touch approach while ensuring high availability.

Insulin

- Products like Insulin have a higher value than Paracetamol but still exhibit steady demand.

- Insulin can be managed similarly by automating the process, trusting the statistical data, and letting the system run the show.

- Closer attention to exceptions is necessary due to the higher value of Insulin.

- Excess stock ties up more capital, requiring careful management.

- Stockouts can lead to significant profit loss, emphasizing the importance of maintaining adequate inventory levels.

Speciality and rare disease medicines

- Speciality and rare disease medicines exemplify high volatility and high value.

- These drugs are expensive, and their demand can be unpredictable.

- Demand is influenced by factors sucstoch as new therapies, changing treatment guidelines, and insurance coverage.

- For these critical products, target service levels must be set high to avoid stockouts, as lost sales can significantly impact revenue and can cause great harm to patients if unavailable.

- When actual demand deviates strongly from the forecast, consensus planning becomes crucial in aligning various stakeholders—such as sales, marketing, finance, and supply chain—to create a unified demand forecast.

- Consensus planning, which integrates external inputs like market data, clinical insights, and patient trends, ensures a more holistic approach.

Flu vaccines and ORS (Oral Rehydration Solutions)

- Both flu vaccines and ORS are highly volatile items, similar to speciality medicines.

- This volatility necessitates careful planning based on a management-by-exception approach.

- Despite their lower value compared to speciality drugs, higher buffer stock levels are required to maintain service levels, especially during peak seasons.

- Implementing a dynamic buffer stock strategy based on the seasonality of these products ensures a reliable supply when demand surges, such as during flu outbreaks.

Key Takeaways for Optimizing Pharmaceutical Supply Chains in the MEA Region

Optimizing pharmaceutical supply chains requires a nuanced understanding of the diverse product assortment and the specific challenges posed by regulatory frameworks and insurance practices in the MEA region. Each market presents unique dynamics that influence supply chain effectiveness, necessitating tailored strategies to navigate these complexities.

By implementing strategic segmentation based on demand volatility and sales value, pharmaceutical companies can enhance inventory management, forecast accuracy. This approach enables teams to prioritize their efforts on items that genuinely require attention, ensuring that critical medications are consistently available when patients need them most.

This proactive approach not only improves operational efficiency but also safeguards patient health by ensuring timely access to life-saving treatments. Ultimately, a well-optimized supply chain not only benefits the companies involved but also enhances the overall healthcare landscape by improving patient outcomes across the region.

Looking for a Pharmaceutical Supply Chain Software?

With various factors like demand fluctuations, regulatory demands, and diverse product portfolios at play, having the right supply chain software is crucial to ensure that critical medications are always available when needed.

Slim4 stands out as an excellent option tailored specifically for the pharmaceutical industry. This powerful software solution is designed to help companies tackle these unique challenges head-on, enabling better inventory management and demand forecasting.

Here’s what makes Slim4 a compelling choice:

- Accurate Demand Forecasting: Slim4 uses advanced algorithms to analyze historical data and market trends, helping you predict demand more accurately. This allows for proactive planning and reduces the risk of stockouts.

- Real-Time Inventory Management: The software adapts to changing conditions, allowing you to adjust inventory levels dynamically. This means you can stay ahead of demand and avoid both excess stock and shortages.

- Smart Segmentation: Slim4 helps you identify and prioritize high-value and high-volatility items. This ensures that the most critical medications receive the attention they need in your supply chain strategy.

If you’re seeking a way to streamline your supply chain operations while ensuring life-saving treatments are always on hand, Slim4 could be the solution you need.

FAQs about Pharmaceutical Supply Chain Management

What challenges do pharmaceutical companies face in supply chain management?

Pharmaceutical companies deal with strict regulatory requirements, unpredictable demand, and a diverse product range. They must ensure compliance with safety standards while managing complex assortments like prescription drugs and over-the-counter products, each with different storage and distribution needs.

What is an Active Pharmaceutical Ingredient (API)?

An Active Pharmaceutical Ingredient (API) is the key substance in a medication that produces the intended therapeutic effect. It’s what makes the medicine work to treat a specific condition, and different formulations of the same API can be used in various products.

How do formularies affect the availability of medicines in the MEA region?

Formularies, which are lists of drugs covered by insurance, directly influence demand for medications. If a drug is added or removed from a formulary, it can significantly increase or decrease its demand, requiring pharmaceutical companies to adjust supply accordingly to avoid shortages or excess stock.

How can automation improve pharmaceutical supply chains?

Automation helps manage products with steady demand, like common over-the-counter drugs, by maintaining stock levels efficiently with minimal manual intervention. For higher-value or volatile products, automation is combined with close monitoring and strategic decision-making to prevent stockouts or excess inventory.