Table of contents

Table of contents- Whitepaper: How to survive a retail business rate raid

- 4 Crucial questions

- Survival of the agile

- The tax burden on UK retail

- The new battle for business rates

- Impact assessment on the retail industry

- Spotlight on homeware retail

- How to respond strategically

- How to use technology for a competitive advantage

- Tactical actions you can take now

- Some areas of focus for retail executives

- Final thoughts and takeaways

Overview

Proposed UK business rate increases for large-format retailers, particularly homeware, threaten margins and require a strategic response. The suggested solution is to mitigate rising fixed costs by adopting technology for smarter supply chain management, optimizing store space productivity, and using data to achieve precise demand forecasting and inventory allocation.

Your store footprint has just become a ticking time bomb. One unfavourable decision from the government and your cost base could explode.

The retail industry’s already under huge pressure from inflation, shifting consumer habits, and fierce online only competition. But now, the proposed changes to business rates could be the tipping point for many large-format retailers. Our whitepaper explores how to turn this threat into a strategic opportunity.

4 Crucial questions

The UK Government has recently proposed a significant overhaul to the business rates system, with a particular focus on larger retail spaces. The changes are designed to rebalance the tax burden between physical and digital retail, but they risk disproportionately impacting brick-and-mortar retailers. Especially those in homeware, furniture, and DIY sectors.

If your business fall within this remit, the more knowledge you arm yourself with, the better prepared you’ll be for the changes up ahead.

Here are some key questions you might be asking yourself:

1. What’s changing?

A revaluation of commercial properties and a potential uplift in rates for large-format stores on top of already high rates.

2. Why now?

To modernise the tax system and reflect post-pandemic shifts in retail.

3. Who’s affected?

Primarily large retailers with expansive footprints—especially in out-of-town retail parks & larger town high streets though all retail stores already facing high rates.

4. What’s the impact?

Increased fixed costs, pressure on margins, and a renewed urgency to optimise store performance.

Survival of the agile

This whitepaper will give you a head start as the industry responds to the government’s proposed changes to business rates and help you and your retail business navigate the meandering turns ahead.

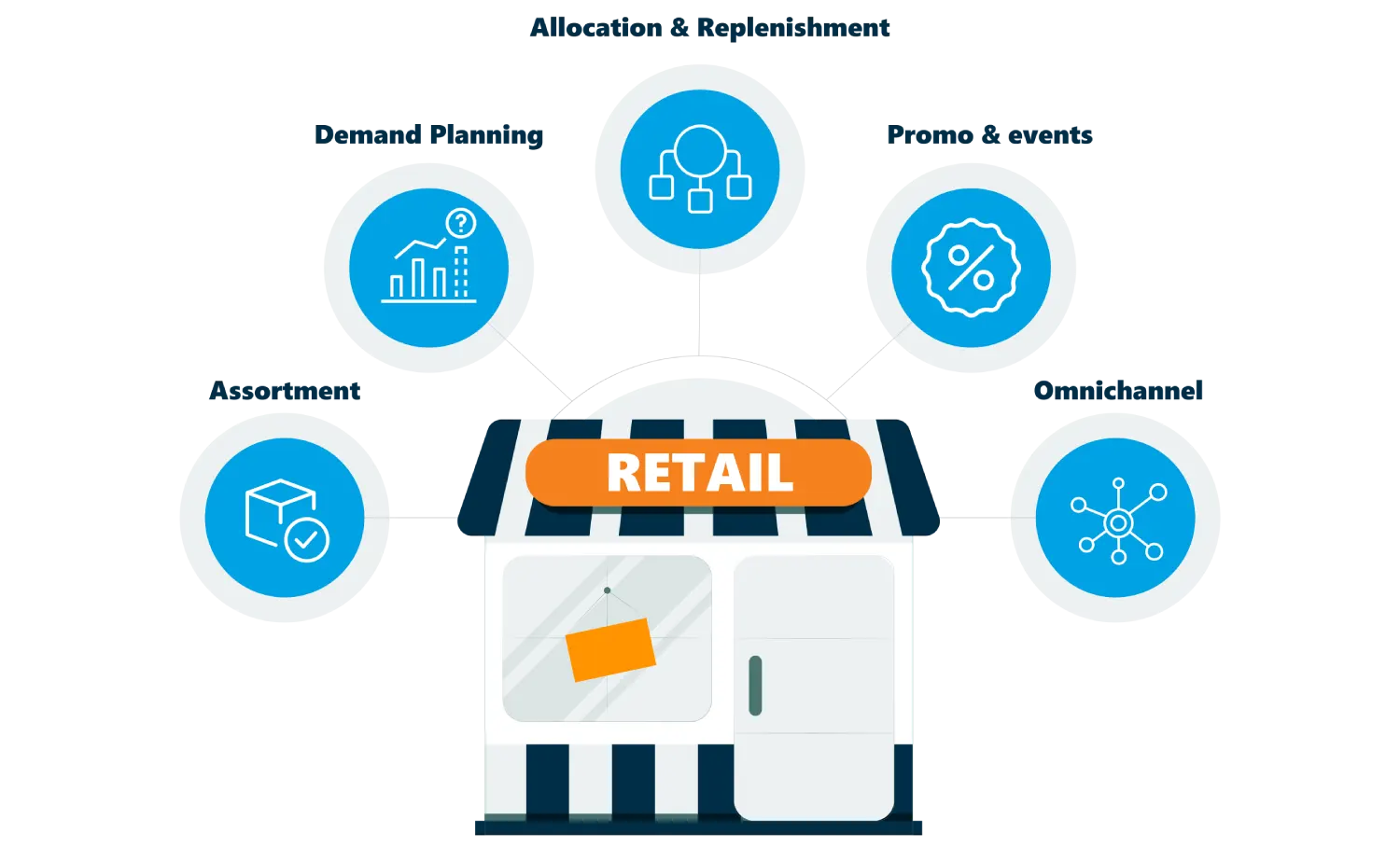

We’ll discuss the impact of rate changes on the retail sector and show why homeware companies might be particularly exposed to the disruption. We’ll explore how adopting smarter demand forecasting, inventory planning, replenishment & allocation can work as a solution to help you mitigate against rate increases.

This whitepaper aims to:

- Analyse the implications of the proposed business rate changes on UK retail.

- Explore how you as a retailer, especially if you’re in homeware, can adapt through smarter supply chain strategies.

- Give you actionable insights to help you maximise the productivity of every square foot of your retail store space.

The tax burden on UK retail

The retail industry contributes 7.4% of all business taxes in the UK, while representing only 5% of GDP. This is a disproportionate burden for the sector.

Business rates alone consume 11% of retail profits, which is the highest among all sectors that make up the commercial landscape.

Corporation tax in the UK has increased from 19% to 25% for profits over £250,000. And National Insurance Contributions for employers has risen to 15%. Further to this, Capital Gains Tax on business asset disposals will rise to 18% by 2026.

The retail sector’s certainly feeling the pinch. There were nearly 7,000 store closures in 2024, and predictions for the future show 17,300 could follow suit by 2034.

The new battle for business rates

What’s changing in business rates in 2025?

The Valuation Office Agency (VOA) has reassessed rateable values, and show early indicators that suggest there will be a significant increase for “large-format stores”.

This shows why homeware stores might be particularly at risk, where large SKUs are on show to the public, across vast customer-facing spaces.

Why is this happening?

The government is under pressure to modernise business taxation and level the playing field with online retailers.

As for when the changes are expected to come into force, the next revaluation is expected to take effect in April 2026. But as with any change that impacts trading and profitability, the sooner your preparations begin, the better equipped you’ll be to limit their impact.

While, for now, the proposed tax increased are only proposals. It’s a strategic inflection point for physical retail. And while retail outfits with large on-show inventory could heavily impacted, every retail operation will feel the squeeze.

Impact assessment on the retail industry

The first hurdle for the retail industry will be the rise in rates. Some large-format retailers could see rateable value increases of 15–25%, depending on the location and property type.

Then, pressure from fluctuating turnover will show its teeth.

In July 2025, 24% of UK businesses reported a decrease in turnover compared to the previous month. That’s a sizeable number of companies and can’t be ignored with respect to the knock-on effect on UK-wide trade.

This proposal comes on top of growing operational costs. For examples, when surveyed, 36% of businesses mentioned staffing costs as their top challenge in 2025. With the rise in cost of living, your staff will be feeling the pinch as much as anyone, and this will rise up the chain to employers.

Linked to this problem is the lowering footfall retailers will experience due to the shortage of disposable income across the country.

With the cost of living rising beyond expected measures, fewer customers will be seen making their way to physical stores, which could lead to further store closures, and a reduction in high street and retail park vibrancy.

Then, there’s price inflation.

It’s only natural that retailers will feel under pressure to pass on higher costs to consumers as they look to protect their margins, but the impact this has on competitiveness might be counter-productive.

And finally, the customer experience for those with the means to continue their consumerism might be the sting in the tail. Investment in stores will naturally reduce, and higher prices from squeezed margins could end up damaging brand perception and reputation beyond repair.

Spotlight on homeware retail

Due to the fact homeware stores typically occupy large spaces with lower sales density, they’re far more vulnerable to the shift in business rates in 2025. Homeware stores typically occupy 10,000–50,000 square feet, which makes them highly exposed.

As an example, the average business rates for large homeware stores could rise from £250,000 to £310,000 annually. And this number could be even higher, depending on location and valuation.

Of course the typical inventory challenges that exist, even under normal circumstances, only complicate matters. Homeware retail outlets tend to stock bulky, seasonal products that mean using their space efficiently is far more complicated than other retail stores.

There’s also their location, which tends to be in out-of-town destinations like retail parks. This shines the spotlight on them even more for rate hikes, and with their lower sales density make it harder to compensate for fixed cost rises.

How to respond strategically

Regardless of the size of your stores, you must now treat every inch of them as profit centres in order to maximise their impact. Especially where each square foot might showcase SKUs with smaller profit margins or lower priced items.

This means you have to optimise space productivity.

Use every bit of reliable data you can to see what drives the most value in-store. Resting on assumptions or guesswork is without a doubt the wrong strategy where statistics can show you home truths you wouldn’t otherwise unearth.

Supply chain agility will also become crucial. This means making sure product availability, in the right place, at the right time. This is an important focus for retail companies under normal conditions but becomes heightened when rates increase and you simply can’t afford to miss out on sales due to ineffective demand planning.

And finally, ensuring a full-price sell-through.

Which means reducing the amount of markdowns throughout your product catalogue by aligning inventory with demand even more precisely than you currently are.

By taking these steps you’ll be strategically fighting against the impact of rate hikes from the government and giving your retail business a better footing to survive against challenging conditions.

How to use technology for a competitive advantage

Technology can be a leveller for retail organisations fighting the impact of tax hikes on the industry. Those who embrace digital transformations will be in a much better position to rise above those that don’t.

It’s not only taxes and costs that are rising in 2025, but consumer expectations too.

To meet higher demands for the customer experience, technology’s no longer a nice-to-have or merely a support function, but a strategic necessity to improve agility, resilience and profitability.

Of course every retail operation will have different degrees of competence with technology, and that includes variance across sites. Digital transformations can take many forms and a long time to roll out, especially for companies with multiple store destinations.

But the cost of rolling out technological advancements will pale in significance to the short-comings you could see in competing against those who go all out for the latest technology.

Of course, not all investments in technology are created equally. You must make sure any financial undertaking is well thought out, and strategically aligned to the business to ensure its efficacy.

Tactical actions you can take now

To execute your strategy in fighting the retail business rate raid, you should shift your focus to some key operational levers.

Store assortment strategy

You should be tailoring your ranges to the local demand and specific store format. Can you use analytics to identify underperforming SKUs? Are you placing those items which sell universally well in the right place? Have you viewed your store through your customer’s eyes?

Seamless omnichannel experience

Can you integrate store and online inventory planning? The more you separate the two, the more complicated it can be to keep up with. What technology is out there to make stocking decisions even easier?

Could you enable ship-from-store and click-and-collect to boost efficiency? Not only will these offerings improve your ability to supply customers, but also dramatically improve the customer experience.

Forecasting and demand planning

Technology can help dramatically for forecasting and demand planning. Guesswork will no longer cut it. It doesn’t even in favourable conditions, let alone what 2025 might have in store.

Can you leverage AI or machine learning to improve the accuracy of your forecasts? You already know forecasts can never be 100% accurate. But your fight to get as close to that as possible should be perpetual.

Make sure you factor in local events, weather, and economic indicators to improve your accuracy.

Promo and event planning

During times when there’s less money to go round, promotions need to work. They need to increase footfall, and maximise the potential revenue made by that increase in interest.

Of course, aligning promotions with stock availability and store capacity is a must.

Can you use events to drive footfall and clear seasonal stock? Do you have the right promotions in place to maximise the revenue each store is making? Are there regional differences in taste or buying habits which make more granular analysis more effective?

Allocation and replenishment

You should be trying to balance stock between distribution centres and stores based on real-time data. It’s great having data on hand to guide your decision making, but data alone won’t make the difference. It’s how you use and interpret that data which is most crucial.

Where can you automate throughout the business to help the bottom line? Can you automate replenishment to reduce manual errors and delays? Are there small improvements you can make across the business to release staff for higher-value operations and activities?

Some areas of focus for retail executives

These are some of the areas retail executives should be putting their attention to in a bid to limit the impact of business rate hikes in 2025.

Operational efficiency

Can you automate tasks? Automation offers a lower cost, lower latency but high impact reward in freeing up humans to focus on higher value, higher touch tasks.

AI and machine learning don’t come for free, but their impact could significantly unlock better margins for your retail businesses.

Can you renegotiate supplier fees? Suppliers are unlikely to reduce their fees for nothing, but with better demand planning and forecasting, you might be able to take advantage of higher economies of scale.

Thus lowering the cost of the supply, and increasing margins to help stomach the fluctuation in rates.

Long-term planning

How are you preparing for reforms across corporate, property, and consumption taxes? Once you understand what the landscape of future business will look like, you can better prepare for it.

Because tax hikes won’t just hurt one part of your business, but may touch areas you wouldn’t think about without careful analysis and planning.

Of course, looking at the short-term is fundamental to improving your situation in the next twelve months, but beyond that, careful long-term planning is a must. Only then can you direct funds to parts of the business that will show a return on investment and guide your retail business to long-term success.

Final thoughts and takeaways

The proposed business rate changes are a wake-up call for UK retail. Without careful planning many could see wholesale change to their ability to keep up.

The industry will no doubt see location closures in the coming months and years as a result of the conditions worsening across the industry.

For your business to avoid these pitfalls, ensure you have the right strategy in place and are constantly assessing which parts of the business can be improved.

Rather than be a constant thorn in your side, or limit your operations, you can view rate changes as a catalyst for transformation.

Those retailers who act now won’t only survive, but emerge leaner, stronger and in better standing against their competitors as a result.

It’s not only about embracing technology, but utilising data to improve decision-making, optimising space and streamlining supply chains.

If you’re able to do all of the above, you’ll be in fantastic shape to come out of 2025 healthily, against all the odds.

Remember, every square foot counts.