Table of contents

Table of contents- Is Economic Order Quantity (EOQ) still relevant in today’s volatile world?

- The order quantity conundrum

- What is the EOQ formula

- How can the economic order quantity help you to reduce supply chain costs?

- How does the economic order quantity impact inventory carrying costs?

- How do batch quantity costs fit into the EOQ formula?

- What impact do purchase costs and discounts have on the economic order quantity?

- ‘EOQ in practice’ Model

- Cost sensitivity and practicality

- Logistic units

- Seasonality

- Some final thoughts on Economic Order Quantity

- Further reading

- Economic Order Quantity (EOQ) FAQs

In 1913, the world was first introduced to the Economic Order Quantity (EOQ) formula. This revolutionary approach would soon go on to redefine the discipline of supply chain management.

But in today’s volatile world, is this 100-year-old formula still relevant?

The answer, of course, is yes!

For many businesses, inventory is typically one of the biggest assets on the balance sheet. If you’re in the manufacturing industry, it’s likely your inventory costs could take up 40% of your total.

For retailers or wholesalers, the number’s even higher. And in some cases, it can be as large as 50%.

That’s a whopping outlay. And something that needs careful management. Owning, maintaining, and managing inventory takes a lot of time, effort and money. And if you get it wrong, it causes a huge amount of stress throughout the entire business.

You obviously need enough in the warehouse to make sure customers are satiated. But you never want too much. After all, in these times of high inflation, soaring costs and general economic woe, it’s never been more important to keep your inventory levels in check.

And for this reason, the Economic Order Quantity is just as useful today as it was back in 1913.

In this article, we’ll dive the into topic of Economic Order Quantity. We will explore how you can use this formula to make better supply chain decisions.

We’ll highlight how you can apply the EOQ principles within your business. And for good measure, we will highlight some potential pitfalls you should watch out for.

The order quantity conundrum

Ordering quantities touch many areas of your business. None more so than inventory height.

Naturally they influence the frequency and volume with which you order. But they’re a big influencer on the day-to-day efficiency of your supply chain operations. As such, the process of determining order quantities should be thought out, planned and strategic.

In practice, this often is not the case.

Order quantities are often not underpinned by strategy or well-intentioned plans but dictated by suppliers. Sometimes, the situation’s even worse and nobody knows how the EOQ number was reached at all.

This leaves a scenario where disproportionate order quantities arise. And in turn, you’ll see expensive mistakes. Mistakes like high inventory levels, unnecessary risks in obsolescence, excessive waste, and the need for additional storage capacity.

On the other hand, order quantities that are too small cause inefficiencies throughout the supply chain and wider business processes. All of which lead to avoidable cost.

But how can you avoid all of this? Simply ordering the right amount of stock is a great place to start.

Ordering correct quantities will lower your operational expenses while boosting your return on inventory investment.

It will help you ensure you can offer your customers the best possible availability with the lowest possible level of stock. And this, in turn, results in a huge improvement on your bottom line.

What is the EOQ formula

Before, we go any further, let’s start with basics.

The EOQ formula was developed by Ford W. Harris in 1913 and updated later on by Wilson (1915) and Camp (1922). Since then, the Economic Order Quantity has become a supply chain staple that has been studied and discussed at length in lecture halls and boardrooms alike.

Economic Order quantity is a big part of supply chain literature and is in applied within a huge proportion of businesses chasing supply chain excellence.

However, let’s not get carried away. The early interactions of the Economic order quantity were not without their limitations.

For example, the traditional Ford model was somewhat restrictive. This is because it required a fixed price and didn’t take things like quantity discounts into account.

Furthermore, the results were based on known and stable demand, which, considering the recent disruption we have become accustomed to, is simply not realistic. Finally, the original formula only considered ordering and holding costs of replenishment.

But despite these limitations, the EOQ formula has been proven time and time again to yield fantastic results. In the next sections, we will explore some of main benefits of Economic Order Quantity.

How can the economic order quantity help you to reduce supply chain costs?

Satisfying the needs of your customers does not come cheap. But that does not mean you cannot take steps to cut your supply chain costs down to size.

The first step in minimising your supply chain costs is to identify the most important cost factors. For companies that operate in an inventory-rich environment, supply chain costs can be roughly categorised by:

- Ordering costs

- Holding costs

- Shortage costs

- Set up costs

- Unit costs

Focus on the major costs

The two most important types of supply chain costs are ordering costs and holding costs. And the former of the two is often underestimated because a large part of it is considered a sunk cost.

Holding costs

Business managers often think they’ve financed their inventory with their own capital. But that doesn’t mean you can ignore costs like these when you make optimisation decisions.

Imagine your company without any inventory. What investments, risks, and expenses would be missing? How much manpower, time, trouble, and effort would you save daily?

The point here is that even if you cannot see the costs directly, there is likely an opportunity for optimisation.

Handing costs

Holding costs are another major type of supply chain cost. They comprise all the costs a business incurs when they handle certain lot sizes. However, many businesses don’t realise handling just one unit involves many different processes.

Let’s take a production facility as an example.

What does it cost to produce just one unit? You have to select and collect the right raw materials, set up a production line, clean up after production, cope with starting-up failures and much more.

Don’t forget the other costs

Although you should focus on the two major cost factors above, all supply chain costs directly influence one another. They also directly influence your business, so keeping on top of them is a wise choice.

To avoid a suboptimal solution, you should incorporate all cost types into your inventory management strategy.

Think of the bigger picture.

When you, for example, optimise for inventory carrying costs, you would lower the ordering quantities. In practice, this often negatively affects your transportation and warehousing costs, because this results in many order lines and probably inefficient use of transportation modes.

Likewise, when aiming for lower production costs by increasing batch order sizes, your inventory and warehousing costs would rapidly increase. The one thing that influences all your supply chain costs when replenishing your inventory position, is the order quantity.

Order quantities drive transportation modes, warehouse operations, and production capacity. When ordering the right logistic quantities, you can excel in operational efficiency. Ordering the correct number of pallet-layers, full pallets, or even truck loads pay off.

And if you optimise order quantities, you significantly improve the use of invested capital in operations and production. Due to the balance between ‘number of order lines to be processed’ and ‘order size to be handled’, improving.

However, be warned, underestimate the capital requirements for inventory management at your peril. Without careful planning, it’s easy to make bad decisions when it comes to transportation mode selection, network design, and sourcing. And they’re three big parts of the process.

In the real world, inventory costs are often underestimated. That’s due in part to purchase managers only looking at ordering costs and forgetting about warehousing, transportation, and other inventory-related costs.

An unrealistic guess of capital requirements can inevitably lead to an unexpected financial setback. Consequently, your inventory investment requirements should be balanced against operating expenses taking heed of the cost of capital associated.

Transportation management’s just one example. Inventory can be lowered by utilising faster transportation modes such as air freight that allow for shorter lead times and smaller order quantities.

Given that your transportation costs will increase, this may sound like an expensive option. However, if you consider that the total inventory and supply chain costs can be lowered, it is possible that the overall financial performance may be improved compared to cheaper transport alternatives.

Finally, consider the impact of knowing the total cost of inventory on procurement decisions. On the face of it, moving production to the Far East might reduce purchase-price costs. But overall, may lead to increased investment due to higher in-transit and safety stock inventories.

In this scenario, it may be the case that the supplier with the lowest purchase-price cost does not always have the lowest total landed costs.

How does the economic order quantity impact inventory carrying costs?

Inventory carrying costs can be split into two areas: capital costs and non-capital costs.

Capital costs are tied up in inventory as stock is often financed up front. Capital costs are paid for financing the asset inventory. The costs that are inevitable when holding inventory are called non-capital associated costs.

Capital costs

Inventory is often considered a short-term asset. However, the flaw in this argument is that as long as a company continues to hold 60 days in inventory, it will need to invest to maintain the current sales.

Therefore, inventory should be considered a ‘permanent current asset’, despite the fact it turns over every 60 days. This is the reason why a long-term cost of capital should be used in the calculation of the inventory carrying charge. Your financial controller should be able to provide you with this figure.

Non-Capital costs

Space and utility costs

Inventory is often stored and handled in a company’s own warehouse or by a third-party logistics provider. When you consider the total costs of storage and utilities, and take the average inventory held into account, you will be able to make an accurate estimate of the holding cost rate.

Administrative costs

Administrative costs are related to the administration and management of inventory by employees and systems. Examples include cycle counting, inventory transaction systems, and management software. If your processes are particularly manual, the labour involved to process an order will inevitably be higher.

Obsolescence and write-off costs

In time, inventory loses value or even becomes unsellable. Finance often writes this inventory off. However, several factors should be considered such as the product’s lifecycle phase and its trendiness.

Inventory handling costs

Inventory is linked to various inbound and outbound handling operations. Material and staffing costs related to these operations need to be considered.

Shrinkage and quality costs

The costs of misplaced, lost, or stolen inventory and the quality control of inventory need to be considered also.

Besides these non-capital costs, there are a few other cost aspects to take into consideration. Examples include overheads, taxes and insurance. And what about the cost of top management’s time being spent on solving problems?

Risk costs

Furthermore, we must bear in mind that most investments in inventory are speculative, especially in the wholesale distribution and retail industries.

There’s typically no legally binding contract that your customers will buy your inventory.

In cases where inventory is built to order, there’s always the risk a customer will change or even cancel the order without compensation. Therefore, it’s important to take risks into consideration when determining the cost of holding inventory.

How do batch quantity costs fit into the EOQ formula?

So far, we have focused mainly on the cost of holding and maintaining inventory. But what about the impact of batch sizes on the economic order quantity formula?

Batch or lot quantity costs are the expenses made for placing, receiving, controlling and creating an order for inventory. They’re also known as ordering costs and are made up of two components: Fixed and Variable costs.

The fixed costs, that remain the same for every placed order, include facility costs as well as maintenance costs of the software that is used for order processing.

Variable costs are proportional to the number of purchase orders that are processed. They can include the cost of creating a purchase order, the cost of reviewing inventory levels, the cost involved in receiving and checking items as they are received from the vendor, and the cost incurred in preparing and processing the payments made to the vendor once the invoice has been received.

Since the total variable costs can be made up of so many different cost types, they can significantly increase the total batch quantity costs.

Order costs are often overlooked by business managers as they perceive these actions taken by employees to be part of their daily routine.

However, when calculating the actual cost of the whole ordering process, they’ll discover it actually costs money to have an item ordered and in stock at their warehouse.

This often comes as a surprise, since they often forget that it costs much more to create ten purchase orders for five items each, than buying fifty items at once from one vendor.

What impact do purchase costs and discounts have on the economic order quantity?

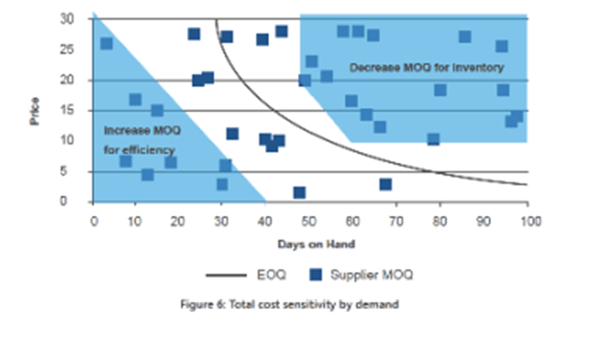

Besides inventory carrying costs and lot quantity costs, there’s a third cost aspect that has a major impact on the total supply chain, in purchasing costs. In practice, there’s often a relationship between the order quantity and the buying price.

Basic economies of scale will tell you higher quantities leads to larger discounts. However, to determine the order quantity for which the total supply chain costs are lowest, all order quantities in relation to all price discounts should be considered.

It’s important to note that the highest price discounts do not automatically imply the lowest total costs. As highlighted in the graph below, where the third price discount range (150 pieces) leads to the lowest total cost, instead of the highest price discount range (300 pieces).

‘EOQ in practice’ Model

Why the Economic Order Quantity formula is popular despite its unrealistic assumptions, is shown by sensitivity analysis. This analysis provides clear insights into the practical use of a method.

The exact answer is, however, not always applicable in practice and can show an increase of other supply chain costs. Therefore, it’s important to know how variations in the main components of the formula can affect the outcomes of the model. Let’s explore some examples in more detail.

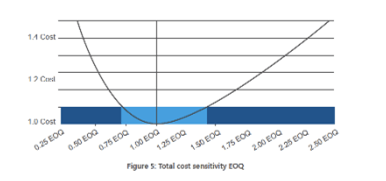

Cost sensitivity and practicality

What’s the effect of applying a different order quantity than the EOQ?

For an increase of 5% in total cost, you can apply an order quantity that is 30% more or less than the EOQ. It can be clearly seen that the EOQ is relatively cost-insensitive near the optimum order quantity. When ordering more than the optimum quantity, costs increase less than when you order less than the EOQ.

Logistic units

Now we’ve established that the outcome of the EOQ formula’s relatively cost-insensitive near its optimum, we can use this information when optimising for other relevant supply chain costs.

Warehouse operations and transportation can be optimised by applying logistic units. Finding the right logistic unit near the EOQ will enhance all supply chain costs.

Seasonality

When the demand for an item follows a significant seasonal pattern, the traditional EOQ method will not always provide the optimal solution.

When it’s close to high season, orders will be placed more frequently when applying a fixed order quantity.

This leads to more inbound operations related to warehousing and transportation and can be disruptive to the outbound operations of your business.

On the other hand, during low season, the inventory position can become very high. Leading to unnecessary high inventory costs and even sometimes difficulties in warehousing operations.

When managing seasonal items, it’s recommended to apply the Economic Order Interval (EOI), also called POQ (Periodic Order Quantity) in literature.

This method ensures that order quantities are adjusted to the changes in demand due to seasonality. In the calculation of the EOI, the optimal cycle length is determined by dividing the EOQ by the total seasonal demand:

Economic Order Interval = EOQ/ total seasonal demand

From theory to practice in 7 easy steps

Hopefully, this article has provided you with the basic knowledge you need for the optimisation of your order quantities. Now you have read the theory, it’s time to put the EOQ model into practice!

To see if your current order quantities are as economical as they could be, apply the following steps to your operation:

- Identify your main supply chain costs.

- Determine the various specific costs per item group.

- Take the numbers and methods from this paper to make a quick scan of your costs.

- Calculate the EOQ for every item

- Compare the outcomes of the formula with your current order quantities and see which ones differ the most from the EOQ.

- Make a root-cause analysis to specify business rules:

- Where can you apply the EOQ directly?

- And where do you need additional business rules?

- Apply the EOQ and recalculate it frequently, especially if there are any changes in costs and demand

Some final thoughts on Economic Order Quantity

EOQ can be a useful tool for the assessment of the current order quantities of your main suppliers. Find and analyse the biggest differences between your current and the optimal order quantities to make quick wins.

If you’re willing to put effort into the optimisation of your order quantities, your risks and capital requirements will decrease, whilst you’ll be able to work more efficiently and most importantly, save a lot of unnecessary costs.

Further reading

Harris, E.,1913. How many parts to make at once. Factory, The Magazine of Management, 10 (2): 135 –136.

Silver, E.A., Pyke, D.E., and Peterson, R., 1998. Inventory Management and Production Planning and Scheduling. John Wiley and Sons.

Zipkin, P.H., 2000. Foundations of Inventory Management. McGraw-Hill, New York.

Muckstadt, J.A. and Sapra, A., 2009. Principles of Inventory Management: When You Are Down to Four Order More. Springer, New York.

Economic Order Quantity (EOQ) FAQs

What is Economic Order Quantity (EOQ)?

Economic Order Quantity (EOQ) is an inventory management formula that helps businesses determine the optimal quantity of a product to order each time to strike the perfect balance between optimised service and minimised costs. EOQ takes into account factors such as demand, holding costs, ordering costs, and lead time to calculate the ideal order quantity.

Why is EOQ important in inventory management?

Why is EOQ important in inventory management?

By calculating the optimal order quantity, EOQ minimizes inventory carrying costs (storage, handling, and depreciation) while reducing the frequency of orders and associated ordering costs (such as setup, transportation, and processing). This enables businesses to optimise inventory levels, avoid stockouts, and minimize excess inventory.

What are the benefits of using EOQ?

The Economic Order quantity offers businesses several key benefits:

- Minimise costs

- Balance inventory levels

- Optimise cash flow & investment of working capital

- Boost efficiency

- Mitigate the risk of waste & obsolescence

- Ensure accurate & rational decision-making

What are the limitations of EOQ?

Despite offering many benefits, EOQ has several drawbacks. For example, the EOQ approach typically assumes that demand is consistent and known. Secondly, the formula makes assumptions around cost which may be difficult to ascertain. Furthermore, to apply the EOQ formula, businesses need robust data as well as a good understanding of how the various factors influence one another.

How often should EOQ be recalculated?

EOQ should be recalculated periodically to ensure its effectiveness in maintaining optimal inventory levels. However, the frequency of recalculating EOQ depends on various factors including changes in demand patterns, lead times, and costs.