Table of contents

Table of contents- Trump’s tariffs and their impact on the global supply chain

- Trump’s tariffs: What levies could be imposed?

- European sectors most affected by Trump’s tariffs

- Effects on the global and european supply chains of Trump’s tariffs

- Trump’s tariffs: a very different impact depending on the country

- Exports from Germany, Italy, France, Spain and the Netherlands to the US

- Conclusion: higher risk for Germany and Italy, moderate risk for Spain and the Netherlands

- FAQs about Trump’s Tariffs

Overview

Donald Trump’s planned new tariffs on imports, especially targeting the EU’s automotive, machinery and chemical sectors, are expected to significantly disrupt global supply chains, accelerate sourcing changes and local production and pose the greatest risk to countries like Germany and Italy.

Donald Trump made it clear during his campaign that, if he were to return to the US presidency, he would resume a trade agenda that was openly protectionist. All the announcements he has made since the beginning of his presidency suggest that he intends to follow through on this commitment.

During his first term he launched a trade war against China and imposed tariffs on products such as steel, aluminium, and certain European foods. Now the new tariffs are set to be broader and more ambitious, with the potential to significantly affect the global supply chain. In this article we will explore how Trump’s import tariffs might impact key sectors in the European Union.

Trump’s tariffs: What levies could be imposed?

Trump has stated that he will implement drastic tariff measures as a cornerstone of his economic agenda. His statements have been fluctuating and, in some cases, even contradictory, but several fronts are beginning to emerge:

Global “reciprocal” tariffs

This would involve not only matching existing tariffs but also addressing other regulatory or fiscal barriers. Specifically, Trump believes the European VAT acts as a trade barrier (although it is actually a tax that applies to both domestic and foreign businesses, not a tariff) and he wants to impose equivalent tariffs in response.

Targeted Sectors

In addition to general tariffs, Trump is threatening 25% surcharges on imports of certain products. Some of the key ‘candidates’ likely to face levies include the automotive sector and pharmaceuticals, among others. There are also discussions around reinstating or increasing tariffs on steel and aluminium (in line with the 25% and 10% tariffs he imposed in 2018).

European sectors most affected by Trump’s tariffs

Although it is still unclear how Trump’s intention to impose import tariffs on the EU will take shape, one thing is clear: certain sectors are particularly vulnerable to these protectionist measures.

Which European sectors are in the firing line?

Automotive industry

This is the number one target. The US has a significant trade deficit with Europe in the automotive sector, particularly with Germany.

A 25% tariff on European cars would considerably increase the price of BMWs, Mercedes, Audis, Volkswagens, and others in the US market, impacting one of the cornerstones of transatlantic trade. In fact, the automotive, chemical, and machinery sectors together account for nearly 70% of EU-US trade so a blow to the automotive industry would have far-reaching ramifications. Germany would be the hardest hit due to its large export volume.

Machinery and capital goods

Europe is a major supplier of industrial machinery, electrical equipment, tools and components to the US. This could be another key target of US tariff policy. Within the EU countries such as Italy, Germany, France and Spain have significant exporting companies in machinery and electrical equipment.

Chemical and pharmaceutical industries

Chemicals, pharmaceuticals, and medicines are among Europe’s top exports to the US. Trump has explicitly mentioned pharmaceuticals as candidates for new tariffs. A high levy would make European medicines more expensive in the US and could even disrupt healthcare supply chains.

Steel, aluminium and metals

The European steel industry already faced 25% tariffs on steel and 10% tariffs on aluminium imposed by Trump in 2018. It is likely that the second Trump administration will reinstate or even toughen these tariffs.

Luxury goods and fashion

Europe leads in luxury products (fashion, jewellery, cosmetics, high-end cars). Analysts suggest that European luxury brands with a strong reliance on the US market are also exposed to Trump’s import tariffs. However, many luxury and fashion firms have mitigated the risk by establishing subsidiaries and production facilities in the US.

Agrifood industry

Although Trump’s new protectionist agenda focuses on industrial sectors, Europe’s agrifood industry is not immune to risk. Iconic EU products – cheeses, oils, wines, cured meats, chocolates and more – may be affected.

Effects on the global and european supply chains of Trump’s tariffs

The imposition of tariffs is likely to disrupt not only bilateral flows with the US but also the dynamics of global supply chains as a whole. Some potential effects and adjustments to the value chain that we may encounter include:

Reconfiguration of sourcing

US importers will look for cheaper alternatives to avoid tariffs. If a European product becomes 10-25% more expensive, it could be replaced by suppliers from countries that are either unaffected or less affected. For example, a US company that buys Spanish machinery might try sourcing it from Mexico, Turkey, or even produce it locally in the US to bypass EU tariffs.

Increased local production

Many European multinationals could accelerate plans to relocate part of their production to the US to avoid tariffs. In fact, several EU firms have invested in US plants in recent years.

Pressure on prices and inflation

An important aspect is that tariffs function as a tax, which is usually passed on to the end consumer in the importing country. If inputs or finished goods become more expensive due to tariffs, part of the added cost is transferred to retail prices. This could add inflationary pressure in the US, which has already been high recently.

Fragmentation of the global supply chain

A risk highlighted by analysts is that such large-scale protectionist policies could lead to the fragmentation of markets, creating a scenario of trading blocs. In this scenario, each bloc would likely source within its sphere of influence (friend-shoring). For example, Europe could buy fewer US products (if there are retaliations) and seek internal or alternative sources from other allies, while the US would reduce European purchases in favour of domestic suppliers or countries with trade agreements.

Trump’s tariffs: a very different impact depending on the country

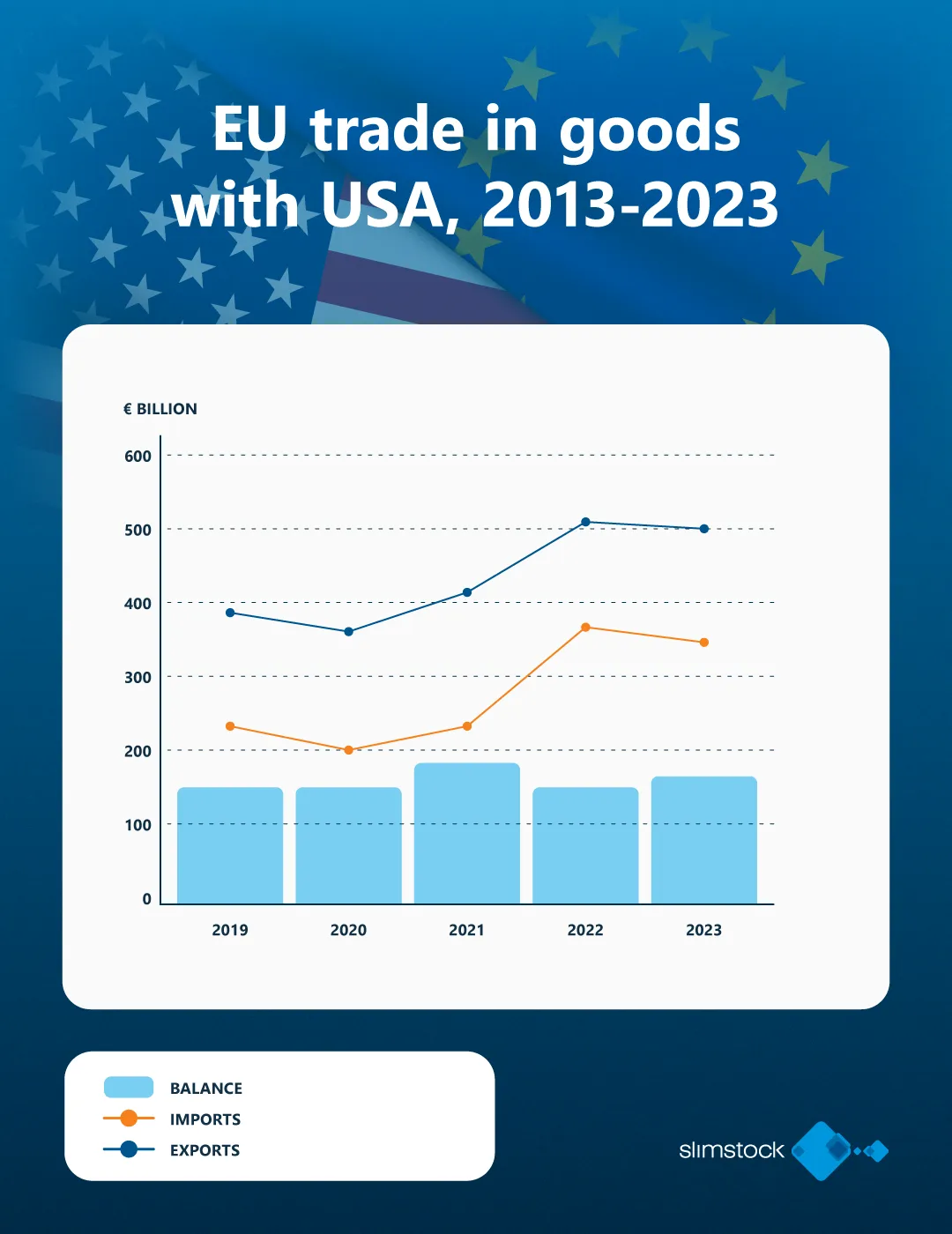

The US tariffs on EU imports will have a very uneven impact across the different countries that make up the Union. The EU-US trade relationship is the most fruitful in the world, with around 1 trillion euros annually exchanged in goods and services. In 2023, the US was the top destination for EU goods exports (19.7% of total non-EU exports) and the EU recorded a goods trade surplus with the US of about 156 billion euros.

However, this trade is not evenly distributed: some countries (such as Germany and Italy) are heavily reliant on the US market and maintain large surpluses, while others (such as the Netherlands and Spain) import more from the US than they export, showing trade deficits.

Exports from Germany, Italy, France, Spain and the Netherlands to the US

The scale of exports to the US varies significantly across these countries. Germany is by far the largest European exporter to the US market with around 157 billion euros in goods exported in 2023. This figure is more than double that of Italy, which exported approximately 67 billion euros. Ireland ranked third in the EU with 51.6 billion euros (although Ireland is not one of the five countries analysed, it stands out due to its high dependence on the US market). France exported about 43.9 billion euros in goods to the US in 2023, while the Netherlands sent around 40.5 billion euros and Spain approximately 18.9 billion euros.

Not only does the absolute value of exports differ but so does the relative importance of the US market for each country. For Germany and Italy, nearly a fifth of their sales outside the EU go to the US (around 22% of their non-EU exports). In contrast, France and Spain are less dependent on the US for their exports: in 2023, only 16% of France’s non-EU exports and 13% of Spain’s were destined for the US. In fact, among the four largest economies in the Eurozone, Spain has the lowest share of non-EU exports to the US. This indicates that the Spanish economy is more focused on other markets (mainly the EU itself) while Germany and Italy have a greater external exposure to the US market.

Conclusion: higher risk for Germany and Italy, moderate risk for Spain and the Netherlands

Germany (and to a lesser extent Italy) face a high risk due to their significant trade surplus with the US, and their key export sectors (automotive, machinery, chemicals) would be directly targeted by tariffs. France occupies a middle position, with some sensitive sectors but less overall dependency. The Netherlands and Spain, with trade deficits with the US and a smaller reliance on the US market for their exports, would suffer less from a decline in US sales. However, they could still face collateral effects, such as reduced port activity or possible retaliatory tariffs from the EU that could increase the cost of imports they depend on.

This heterogeneity explains why the EU as a whole is seeking a negotiated solution, even though it must balance the disparate national interests of its members. Nevertheless, there is a common denominator among all EU countries: the firm belief that a trade war would be detrimental for everyone.

FAQs about Trump’s Tariffs

What are Trump’s tariffs?

Trump’s tariffs refer to the taxes imposed by US President Donald Trump on certain imports as part of his protectionist trade policies. These tariffs were designed to reduce the trade deficit and encourage domestic production by making foreign goods more expensive.

Why is Trump imposing tariffs on the European Union?

Trump is imposing tariffs on the EU as part of his “America First” trade strategy. He believes that the EU has unfair trade practices, such as the European VAT, which he sees as a barrier to US exports. These tariffs aim to address the trade imbalance and encourage the EU to negotiate more favorable terms with the US.

How are Trump’s tariffs affecting global trade?

Trump’s tariffs are disrupting global trade by impacting supply chains. Countries heavily reliant on exports to the US, such as Germany and Italy, are facing economic pressure. The tariffs have also led to retaliatory tariffs from other nations, further complicating international trade.

How are Trump’s tariffs impacting the US economy?

Trump’s tariffs are meant to protect US industries and create jobs, but they are leading to higher prices for many goods in the US, affecting consumers. They are also disrupting global supply chains and increasing the cost of materials for US manufacturers who rely on imported goods.