Table of contents

Table of contents- EU–Mercosur agreement: progress and implications for trade

- What is the European Union–Mercosur agreement and why is it emerging now?

- Key points of the EU–Mercosur agreement

- Economic impacts of the UE-Mercosur deal

- EU-Mercosur trade agreement challenges and discussions

- Status of the agreement: current situation and next steps

- Why the UE-Mercosur agreement remains strategically significant

Overview

The European Union and the Mercosur bloc reached a political agreement on a wide-ranging trade and partnership deal. However, the deal has not yet entered into force. It remains subject to approval by the European Parliament, national parliaments in EU member states, and the legislatures of Mercosur countries.

After nearly 25 years of negotiations, the European Union and the Mercosur bloc reached a political agreement on a wide-ranging trade and partnership deal. However, despite political agreement at executive level, the deal has not yet entered into force. It remains subject to approval by the European Parliament, national parliaments in EU member states, and the legislatures of Mercosur countries.

This article explains what the agreement contains, why it has become controversial, and what businesses should monitor as the ratification process continues.

What is the European Union–Mercosur agreement and why is it emerging now?

Mercosur is a South American trade bloc made up of Brazil, Argentina, Paraguay, and Uruguay, created to promote economic integration and free trade among its member states. The discussions related to the EU-Mensocur agreement began in the 1990s, when global economies were still reorganising after the fall of the Berlin Wall.

It took nearly 25 years of negotiations for Mercosur and the European Union to finally reach an agreement that creates the world’s largest free trade area, involving more than 720 million people. Together, the two blocs account for about 25% of all wealth produced globally.

The agreement arrives at a particularly sensitive moment for international trade. Customs tariffs and restrictions have been increasing, especially on the part of the United States, a relevant trading partner for both blocs. In this context, the understanding between the European Union and Mercosur stands as a clear signal in favor of cooperation and multilateralism.

For Europe, the goal is to broaden partnerships and reduce dependencies in an increasingly unstable trade environment. For Mercosur, the agreement opens the doors to one of the world’s largest consumer markets. If consolidated, it becomes even more relevant in a landscape marked by geopolitical tensions, fragmentation of global supply chains, and disputes among major powers.

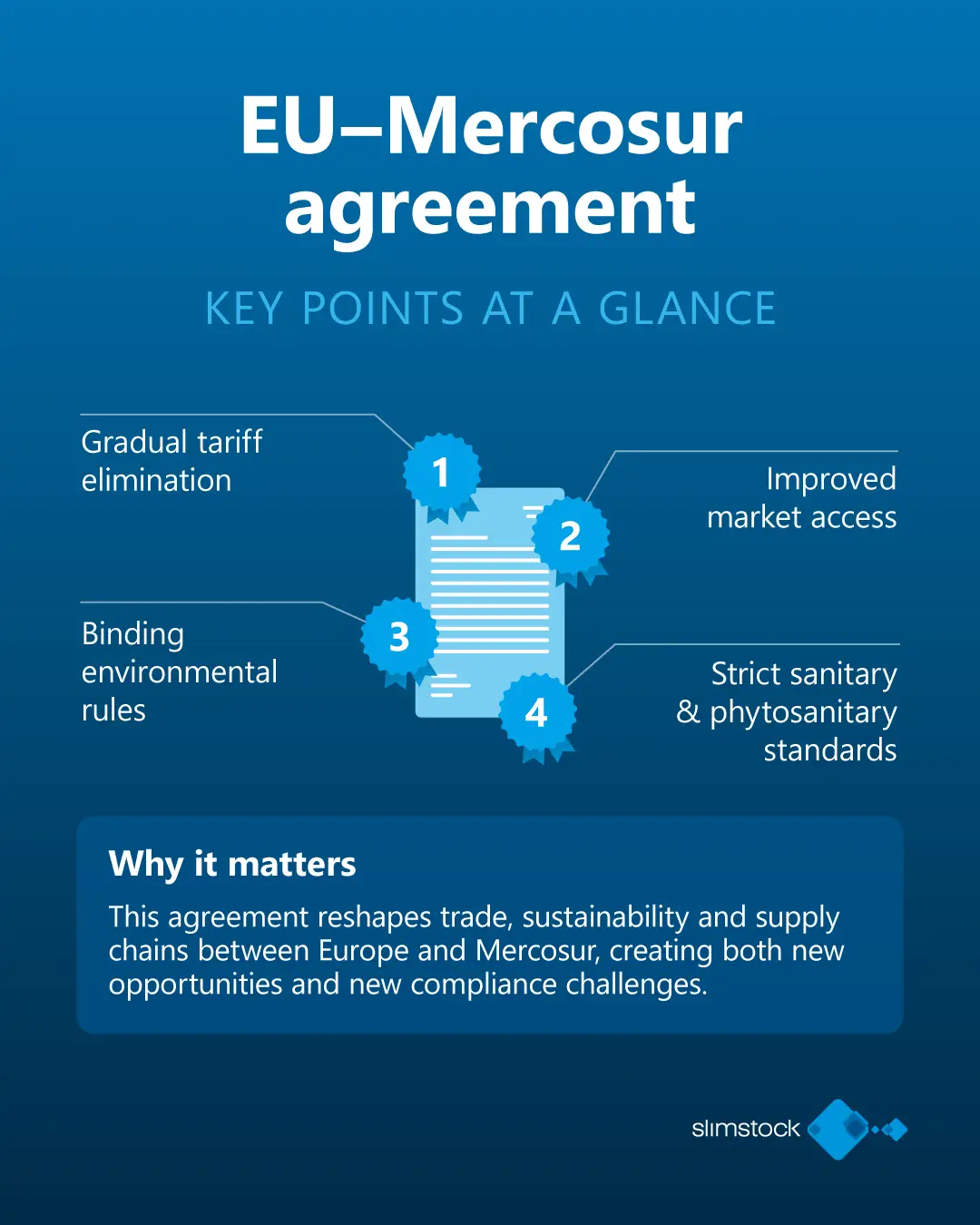

Key points of the EU–Mercosur agreement

The EU–Mercosur trade agreement is structured around a set of core provisions that define how market access will expand, how sensitive sectors will be protected and how sustainability and regulatory standards will be enforced.

1. Gradual elimination of import and export tariffs

The main pillar of the agreement between Mercosur and the European Union is the gradual elimination of customs tariffs. Within up to 15 years, Mercosur is expected to eliminate tariffs on 91% of European goods. On the other side, the European Union will remove 95% of tariffs on Mercosur products within a period of up to 12 years. This change represents significant gains for several sectors in both blocs.

2. Market access for industrial and agricultural goods

There are immediate impacts for industry. From the start of the agreement, various industrial products will face zero tariffs. These include machinery and equipment, automobiles and auto parts, chemical products, aircraft and transportation equipment. Improved market access strengthens industrial integration and encourages cross-border investment, particularly in higher value-added manufacturing.

In the agricultural sector, especially on the European side, safeguards have been provided for. The European Union may temporarily reintroduce tariffs if imports exceed predefined volumes or cause significant price drops in chains considered sensitive. This balance aims to increase trade flows without destabilising domestic markets.

3. Binding environmental and deforestation-related rules

Environmental commitments are a central and non-negotiable element of the EU–Mercosur agreement. Products benefiting from preferential access cannot be linked to illegal deforestation, and environmental clauses are legally binding. Compliance with these rules requires greater transparency and traceability across supply chains, creating both regulatory challenges and competitive advantages for producers that meet sustainability standards.

4. Strict sanitary and phytosanitary standards

Sustainability, in fact, runs throughout the entire agreement. Sanitary and phytosanitary rules remain strict, reinforcing the importance of traceability. There is deeper integration of production chains. In Brazil, where around 90% of the energy matrix is clean, the economy will need to meet even stricter quality standards, especially in animal and plant sanitary controls, to access the European market.

5. Integration of EU–Mercosur production and supply chains

Beyond tariff reductions, the agreement promotes deeper integration of production chains between Europe and Mercosur. By harmonizing rules and improving market access, it encourages the development of cross-border value chains in industry, agribusiness, energy and manufacturing. This integration supports greater efficiency, resilience and alignment with sustainability and digital transition goals.

Economic impacts of the UE-Mercosur deal

The European Union is the second-largest destination for Brazil’s industrialised and higher value-added products. As the largest economy in Latin America, Brazil stands to see increased investment in its industrial base. With the need for working capital to support investments in infrastructure and productive expansion, efficient inventory management becomes even more strategic.

Brazil can expand exports, particularly in the agribusiness and industrial sectors. Products such as coffee, orange juice, corn, cotton, pulp, iron ore, ethanol and biodiesel gain ground. On the distribution side, there will be greater access to European products.

Europe, in turn, is expected to export automobiles, alcoholic beverages, chocolates, olive oils and cheeses to Mercosur. For Brazil, the agreement also opens opportunities to advance in the production of higher value-added goods.

As part of a long-term effort toward greater sustainability, especially in the transition to cleaner mobility, the agreement allows Europe to access a large consumer market and expand its presence in global value chains. The automotive sector, in both production and distribution, benefits from access to critical raw materials such as lithium, graphite and manganese, which are essential for manufacturing electric vehicle batteries.

The European chemical industry also benefits, particularly in downstream segments of the chain such as machinery, automotive and cosmetics, while gaining access to raw materials that are currently scarce or non-existent within the bloc.

Overall, the European Union strengthens its position in global supply chains and increases its resilience against future disruptions. Companies gain more predictable and stable access to inputs essential for the green and digital transitions.

EU-Mercosur trade agreement challenges and discussions

The EU–Mercosur agreement has faced sustained criticism, especially within the European Union. Key concerns include:

- Environmental impact: Critics argue that increased agricultural exports from South America could accelerate deforestation and undermine climate goals, despite the inclusion of environmental clauses.

- Agricultural competition: European farmers, particularly in beef, poultry and sugar sectors, worry about price pressure and market disruption.

- Governance and enforcement: Questions remain about how effectively environmental and labour commitments can be monitored and enforced in practice.

- Industrial development in Mercosur: Some stakeholders in South America express concern that the agreement may reinforce dependence on commodity exports rather than supporting industrial upgrading and technological development.

These issues have led to political resistance in several EU member states and within the European Parliament, contributing to delays and legal scrutiny of the agreement.

Status of the agreement: current situation and next steps

Although the EU and Mercosur reached a political agreement and have finalised the text, the deal has not yet entered into force.

The agreement must be:

- Approved by the European Parliament,

- Ratified by EU member states’ national parliaments,

- Ratified by the legislatures of Brazil, Argentina, Paraguay and Uruguay.

As of early 2026, the European Parliament has raised legal and political objections, and parts of the agreement have been referred for judicial review, effectively delaying ratification. Several EU governments have also expressed reservations, particularly regarding environmental safeguards and agricultural impacts.

Until these processes are completed, the agreement cannot be fully implemented, and no tariff reductions or trade preferences have taken legal effect.

Why the UE-Mercosur agreement remains strategically significant

Despite political obstacles, the EU–Mercosur agreement continues to be viewed as strategically important by many policymakers and businesses. It reflects an effort to strengthen multilateral trade cooperation at a time of growing geopolitical uncertainty, fragmentation of supply chains and increased use of trade restrictions.

If ratified, the agreement could contribute to more diversified trade relationships, improved regulatory cooperation and greater predictability for cross-border business. At the same time, its future depends on addressing environmental, social and economic concerns in a way that satisfies both European and South American stakeholders.

For companies operating between Europe and South America, understanding the agreement, and the political debate surrounding it, remains essential for strategic planning, risk assessment and long-term competitiveness.