Overview

Stockouts hurt retailers through lost sales and customer switching, with most issues stemming from internal planning problems like legacy systems and human bias. Overcoming this requires modernizing planning with AI-enhanced forecasting, data-driven ordering, and centralized replenishment to protect customer trust and improve financial performance.

In supply chain management, stockouts are often seen as an unavoidable reality, a natural byproduct of volatile demand and supply chain disruptions. Many industry professionals accept them as part of doing business. But do we truly understand the full impact they have?

Major retailers like Walmart are familiar with stockouts as well and notice the notable impact these stockouts have. In 2014 the company lost nearly $3 billion in potential sales due to out-of-stocks (Rosenblum, 2014). Instead of simply accepting this loss, Walmart took action. By improving its planning processes, the company managed to reduce stockouts by 16%, meaning fewer sales were lost the following year.

But how many planners take a step back to truly assess the cost of stockouts and the factors driving them? Recognising stockouts not as an unavoidable cost of business but as a solvable challenge can shift the way retailers approach inventory management.

The customer’s reaction: what happens when stock runs out?

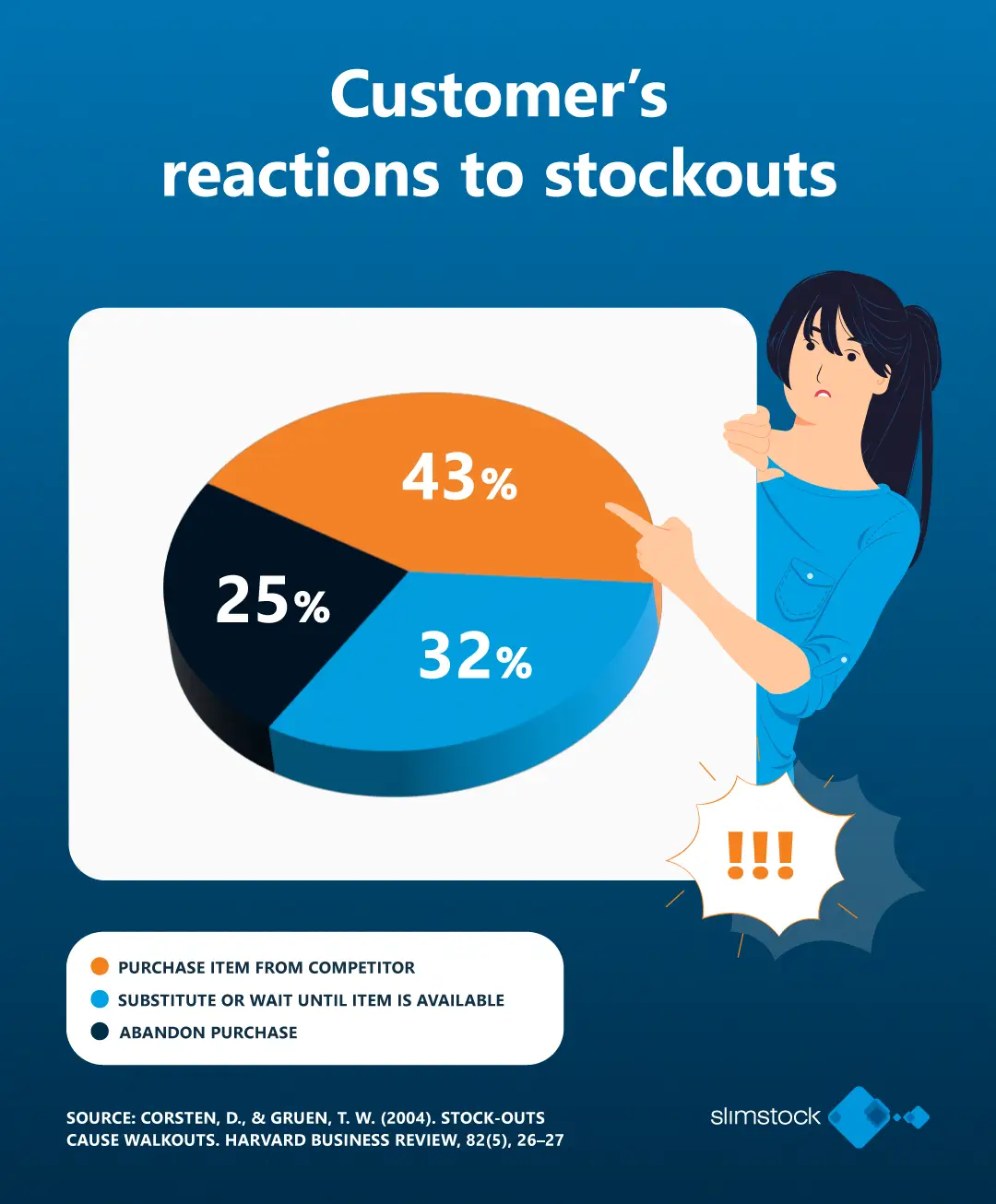

A study of Corsten and Gruen (2004) reveals that customers react in four different ways when faced with a stockout. Some may substitute the item with a similar product or wait until it’s back in stock, responses that may have a limited impact on the business. However, the other two reactions can have serious consequences: part of your potential customers will abandon their purchase entirely. And a significant part will go directly to a competitor to buy the product in their store.

These results show that a customer might be way less loyal than a retailer might think. This reaction results in a 100% loss of margin on these potential purchases and severely damage customer trust.

The first and most apparent cost of a stockout is the missed revenue opportunity. Research shows that stockouts lead to an average of 4% in lost sales (Corsten & Gruen, 2004). In 2021, CPG (Customer Packaged Goods) retailers even lost 7.4% of their sales due to stockouts (NielsenIQ, 2022).

Beyond the topline impact, stockouts also come with operational costs. Expedited shipping, last-minute orders and the scramble to recover availability can add up quickly, eating into margins. While these costs are measurable, the intangible damage to your brand and customer trust can be even more significant.

Given these risks, the cost of preventing stockouts, through better inventory practices and proactive investments, might be far more worthwhile than many retailers assume.

Pitfalls in inventory planning and how to overcome them

Stockouts often seem to be caused by external elements such as demand spikes, supply chain disruptions or global events. However, a deeper look reveals that 72% of stockouts are rooted in manageable planning issues (Corsten & Gruen, 2004).

When looking at the root causes of the planning issues companies face, the following are often underlying reasons for stockouts:

- Legacy systems: Many companies still rely on outdated legacy systems that were designed for static planning processes. These systems struggle to adapt to modern inventory challenges, making it difficult to optimize stock levels effectively.

- Human bias in ordering: When ordering decisions are influenced by personal judgment rather than data, it often leads to imbalances, either overstocking, which ties up capital, or stockouts, which result in lost sales and dissatisfied customers.

- Decentralized ordering process: When store managers handle ordering independently, it takes away valuable time that could be spent assisting customers. Additionally, without standardised processes and centralised data management, companies face inconsistencies in inventory records, which leads to inefficiencies across the business.

Even in centralised systems, flaws in purchase order planning, such as static order policies or poor data quality, can leave retailers unable to respond to shifts in demand effectively.

Meanwhile, the remaining 28% of stockouts are tied to supply chain planning challenges. These can include mismanaged shelf space, poorly aligned product introductions or external disruptions, factors that can be mitigated with proactive and data-driven planning.

A new approach to modern day planning

To minimise stockouts, companies can focus on several key areas that drive immediate impact:

- Refine demand planning: Cleanse demand history of outliers, classify items to apply the right forecasting methods and enrich forecasts with external inputs where needed.

- Enhance forecasting with AI: Modern AI-driven algorithms can improve accuracy beyond conventional forecasting techniques.

- Take an approach to ordering based on data: Limiting human bias ensures more balanced inventory levels and reduces both overstocking and stockouts.

- Focus on inventory management driven by service levels: Instead of relying on fixed days of cover, dynamic safety stocks help maintain the right balance between availability and efficiency.

- Centralize replenishment: Standardised processes improve efficiency, reduce errors and free up store managers to focus on customers.

Stockouts may be a familiar challenge for retailers, but they are far from an unavoidable reality. By understanding the true cost of stockouts, not just in terms of lost sales but also the long-term damage to customer trust and competitive positioning, retailers can begin to see them as a solvable problem rather than an inevitable consequence of doing business.

By embracing a segmented, data-driven approach, retailers can achieve the delicate balance between minimizing stockouts and avoiding overstocking. The result? Stronger customer relationships, improved financial performance, and a competitive edge in the market.

Empty shelves don’t have to be the norm. With the right strategy, they can become a thing of the past.

- Corsten, D., & Gruen, T. W. (2004). Stock-Outs cause walkouts. Harvard Business Review, 82(5), 26–27. https://dialnet.unirioja.es/servlet/articulo?codigo=851988

- NielsenIQ. (2022, February 9). CGP retailers lost out on 7.4% in sales to Stock-Outs in 2021. Food Manufacturing. https://www.foodmanufacturing.com/supply-chain/news/22043873/data-cgp-retailers-lost-out-on-74-in-sales-to-stockouts-in-2021

- Rosenblum, P. (2014, April 15). Walmart’s out of stock problem: Only half the story? Forbes. https://www.forbes.com/sites/paularosenblum/2014/04/15/walmarts-out-of-stock-problem-only-half-the-story/