Table of contents

Table of contents- Production Planning Q&A: Unlock Efficiency Gains Throughout Your Manufacturing Operation

- What is production planning?

- What elements make up the production planning process?

- Which methods or tools are most effective in optimising production planning?

- How is demand volatility managed in the production planning process?

- How are bottlenecks in the production planning process managed?

- How is production planning coordinated with other departments within an organisation?

- Teka reduces stock-outs by 69% with Slim4

- What are the key performance indicators (KPIs) used to assess the effectiveness of production planning?

- Conclusion

- Production planning FAQs

The objectives of production planning are clear: to maximise productivity and plan manufacturing to meet customer expectations while minimising excesses or stock-outs. Yet, manufacturing environments have many nuances compared to other links in the chain.

These differences lie mainly in that manufacturing companies are the main players in the supply chain that transform raw materials and semi-finished products into finished products ready for sale to the end customer.

An effective production planning process must encompass several phases:

- Analysing demand.

- Determining an optimal inventory policy.

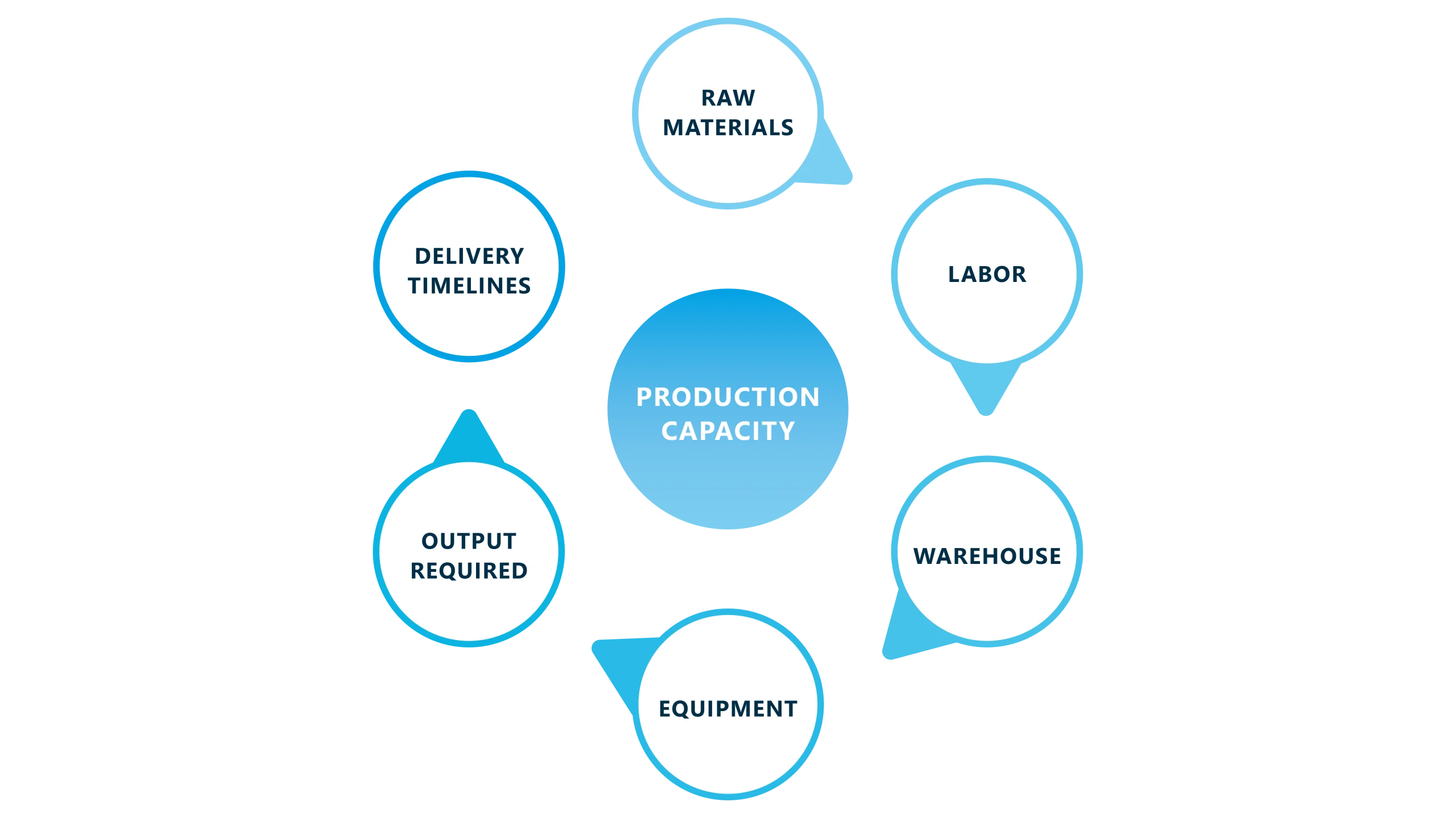

- Determining production capacity.

- Evaluating existing raw materials and supply plans.

- Fulfilling the requirements of quality control and what is determined by a wider continuous improvement process.

In this blog, we will focus on the production planning process, analysing all its phases, and reflecting on how technology can optimise your approach to production planning.

What is production planning?

When we talk about production planning, we are referring to the strategy that distributes resources, time and activities to guarantee efficiency and the fulfilment of objectives in the manufacture of goods or provision of services. Broadly speaking, what this process tries to do is to anticipate demand just like the rest of the links in the supply chain, but at the same time it must also take into account other specifics such as the optimisation of raw materials, labour and machinery used in manufacturing and the synchronisation of processes to achieve optimum production levels.

Another distinguishing feature of manufacturers – and one that they must take into account when planning production – is the constraint on production capacity. While a wholesaler or retailer usually has the option of ordering more stock from its suppliers, a manufacturing company may find it difficult to produce more product, as it may be affected by both the limitations of its suppliers and its own production capacity.

Where does the production plan fit into the planning cycle?

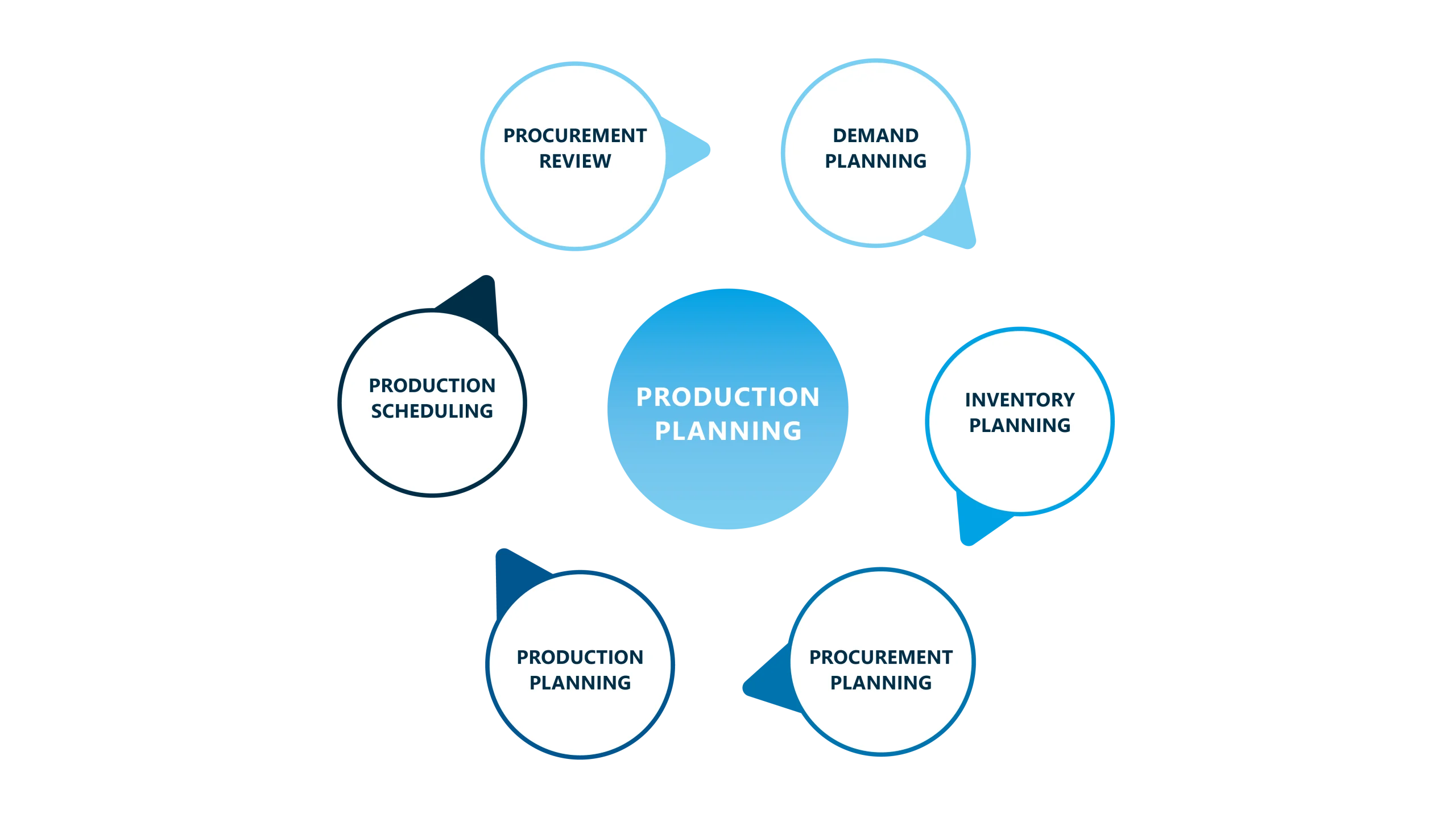

Demand Planning – Inventory Planning – Procurement Planning – Production Planning – Production Scheduling – Procurement Review

This is the recurring cycle of planning for a manufacturing company. Let’s look at each stage in a little more detail.

This consists of forecasting future demand for each item in the assortment taking into account every sales channel.

Inventory Planning

This consists of calculating the level of inventory that you need to maintain at each location to meet the expected demand and the variations that may occur.

Procurement Planning

This is the forecast of the purchasing requirements to be made in order to maintain the proposed inventory levels for raw materials and products that are not manufactured in-house.

Production Planning

This is the forecast of production requirements to maintain the proposed inventory levels of the goods manufactured by the company itself.

Production scheduling

This is the production schedule that is carried out on the basis of production planning but going into greater detail, taking into account the restrictions of the production lines, the product changeover rules of the lines, the line cleaning needs and all the possible characteristics that limit, restrict or shape production.

Procurement Review

Once production has been scheduled, the procurement plan should be reviewed to ensure that the necessary raw materials are available.

What elements make up the production planning process?

Within production planning, there are different interconnected elements that need to be considered. These include:

Production strategy

It is important to consider whether you have a Make To Stock or Make To Order production model. Depending on this initial strategy, we move on to more detailed production considerations.

For example, is it possible to stop the production process, for instance at weekends? Or is it is necessary to always work at 100% capacity? It is important to establish clear production goals that are aligned with the overall strategy of the business.

Production schedules

Creating a detailed production calendar indicating the dates on which the lines can be worked on, and specifying the resources allocated to each task or operation, is one of the main aspects of our production plan.

Bottlenecks and production rates

In all production lines there are bottlenecks that are marked by production rates. It is important to work on these rates to improve line performance.

It is these production rates, together with the production schedules, that determine the production capacity.

When it comes to establishing production rates for planning purposes, one of the most common misconceptions is to think that my plant is going to produce more product per hour than it has historically achieved. When planning using these inflated rates, what happens is that we think we’re going to have more product than we’re actually going to be able to produce. By doing so, we’ll incur stock-outs and our reputation with our customers will decline because we’ll be unable to meet our delivery commitments.

Availability of materials

Feeding the production lines with raw materials, components and auxiliary materials is critical. In some cases, some of these raw materials may be the ones that set the constraints on the production plan.

On the other hand, determining the materials required for production involves working with bills of materials (BOMs), calculating the quantities required, and scheduling procurement.

Resource availability

Sometimes assigning personnel, equipment and other resources to specific tasks or operations according to the production schedule can be a constraint. We must ensure the availability of trained and skilled resources for production tasks.

Quality control

Implementing measures to ensure that products meet quality standards throughout the production process is important and necessary. This includes examinations, inspections and monitoring of quality control procedures. Since quality controls determine reductions in production levels, the production rate should be adjusted to ensure sufficient quantities of valid products are produced.

Continuous improvement

Analysing production processes, identifying inefficiencies, and implementing changes or improvements to increase productivity, reduce costs, and improve overall effectiveness are all necessary tasks in any manufacturing environment.

Improvements obtained through these processes must be aligned with the parameters used for production planning.

Which methods or tools are most effective in optimising production planning?

When planning production, we must start from good master data, which shows us the possible production lines for each item, the production restrictions and the average production rates for each of the items (quantity of product obtained per hour of production).

Once we have this data, we can do the planning in different systems. If we start from the most basic, we’d talk about an Excel spreadsheet. This tool offers great flexibility but, at the same time, it can also entail a risk, due to the limitations of the lack of collaborative functionalities, scalability, and low operational efficiency and precision.

When the company is of a significant size, it is most common to use specific planning systems.

Infinite planning systems

Within the field of planning systems, we have the infinite capacity planning systems. These systems plan what has to be produced based on the demand forecast and inventory planning, but without taking into account any limitation in the production capacity. This type of planning is suitable in environments where the production capacity is much higher than the manufacturing load of the plants.

When the plant is approaching its production limit, and there is not always enough capacity to cope with the manufacturing needs, it becomes necessary to rely on other types of tools.

Finite capacity planning systems

The planning systems calculate for each time period the workload that the plant would have, and compare it with the available capacity. If the production plant in that period can cope with the load … great. But in those periods when the workload exceeds the available capacity, alternatives must be analysed that allow some of the following options: (a) reduce the load, (b) look for alternative production lines, (c) bring forward or delay production, or (d) increase production capacity through, for example, shifts or overtime.

The load and capacity calculation is done taking into account average production rates in the key production process that sets the work rate (average output per hour). In some environments, additional sequencing tools are necessary.

Once we have the production planning at any of these levels, it is time to execute this planning. To control how production is being executed, the OEE (Overall Equipment Effectiveness) that is being obtained and the raw materials, components, working hours and production resources that are being used, MES (Manufacturing Execution Systems) are utilised. These represent a layer above the plant’s SCADA (Supervisory Control and Data Acquisition Systems) and provide all the information necessary to follow the manufacturing processes in the plant.

How is demand volatility managed in the production planning process?

As previously mentioned, production plans are based on demand forecasts and inventory schedules. However, plans may not be met because demand is higher than expected, or because raw materials do not arrive, or because the manufacturing process does not produce the expected quantities. We may therefore be forced to change our production plans. One factor to bear in mind is that we must always respect the production freeze period – ie the days when the production plan cannot be changed.

Another possible alternative when plans change is to outsource part of the production to another company, or to move it to another plant within the company.

When making changes in production, it is always necessary to validate the availability of raw materials and their lead times. For this reason, the potential of having alternative suppliers who are closer to the customer is recommended, thereby reducing lead times and strengthening the ability to cope with any changes in plans.

How are bottlenecks in the production planning process managed?

A bottleneck in a production process is understood to be that part of the process that limits the production capacity. This bottleneck is the one that marks the production rate of a production line as it is the one that indicates the maximum capacity of the line.

One of the main tasks of production engineers is to try to eliminate or mitigate these bottlenecks. To do so, measurement and control procedures must be put in place that can lead to improving the performance of this part of the production process.

How is production planning coordinated with other departments within an organisation?

Within the company’s processes, coordination between the commercial and operations departments, together with the compliance of the financial departments, plays a key role.

With a view to this coordination, in all large production companies, sales and operations planning (S&OP) meetings must be held at least once a month. At this meeting, in addition to reviewing past sales and operations performance, demand plans, inventory plans and production plans are discussed.

We also analyse in detail any critical points where we foresee a possible service problem or overcapacity problems in order to be able to take consensual decisions in the interest of the company as a whole (and not just in the interest of individual departments).

Teka reduces stock-outs by 69% with Slim4

Teka is one of the world’s leading companies in the manufacture and sale of household appliances.

After adopting Slim4 for the management of its supply chain, the company managed to reduce stock breakages by 69% at a global level, and by up to 80% in the case of category “A” items. In the same way, Teka also managed to increase assortment turnover by 33%.

In the case of production companies, Slim4 proposes quantities to supply and to produce for each period of time. If we focus on the quantities to be produced, the platforms also analyses whether these quantities are viable in our production lines or whether we need to “move” production to other resources or to other plants, to change production periods, increase production capacity or even to subcontract production to an external party.

The production planning capabilities of our advanced supply chain planning platform, Slim4, enables the complete integration of the Supply Chain, connecting not only the sales, inventory and procurement planning processes, but also the production processes for manufacturing companies. In this way, with a single tool, it is possible to carry out all the necessary processes to achieve fully joined-up end-to-end planning.

What are the key performance indicators (KPIs) used to assess the effectiveness of production planning?

When measuring the effectiveness of production planning, we can use different key performance indicators (KPIs), as follows:

Planned production vs quantity produced

The first KPI would be the comparison between the planned production quantity and the quantity produced. This indicator shows us whether we have made coherent and feasible plans, and whether the plants are working as they should.

Overall Equipment Effectiveness

Another indicator we can take into account is the OEE (Overall Equipment Effectiveness) which measures how efficient a factory actually is. The plant can only be efficient if it is being planned properly.

OTIF

If we want to measure the overall standard of the planning process, we can check the final results of this process. This can be measured through customer satisfaction which, in turn, can be measured by the OTIF (On Time In Full) level to analyse which orders I have been able to fulfil completely and within the timeframe desired by the customer.

Conclusion

Production planning, the key to coordinating our planning processes and being efficient.

In the day-to-day running of our companies we are faced with numerous problems: lack of manpower, lack of production capacity, lack of raw materials, lack of storage … These are all risks that manufacturing companies face and that threaten their efficiency, but that can be mitigated with good planning in general, and good production planning in particular.

However, plans may not always be realised. This is something we see all the time today, with supply chain disruptions becoming more and more common. It is in these situations that companies must demonstrate their adaptability and resilience. And the only way to achieve this is through supply chain technology that allows you to be agile and have visibility across the entire chain.

Production planning FAQs

How can Artificial Intelligence help to make production planning more efficient?

Through advanced algorithms, AI can identify patterns, minimise costs and improve resource allocation, facilitating more informed decision making. This leads to more efficient production, reduced waste, and better adaptation to changes in market demand.

What are the main risks of ineffective production planning?

Inefficient production planning leads to financial risks by generating cost overruns and under-efficiency in resource allocation. It can result in delivery delays, unbalanced inventories, customer dissatisfaction, wasted resources and reduced competitiveness compared with other companies. In addition, it affects the supply chain relationship and can weaken the company’s position in terms of demand fulfilment and product quality.

What are the differences between an infinite and a finite planning system?

An infinite planning system does not consider capacity constraints and assumes unlimited resources, which is not true for all companies. In contrast, a finite capacity system takes into account resource constraints, such as machinery and manpower, resulting in more realistic schedules that are tailored to the available capacity. Finite scheduling is crucial to avoid overloads and to maximise efficiency in resource-constrained production environments.

What is a bottleneck in a manufacturing company?

In a manufacturing company, a bottleneck refers to a specific point in the manufacturing process that limits production capacity. This point operates at a lower capacity than other parts of the process, creating a bottleneck in overall efficiency. Bottlenecks can be caused by supply chain constraints, process inefficiencies, production capacity problems, or any factor that significantly impedes production flow.