Table of contents

Table of contents- Agile Strategies for the Dynamic Manufacturing Supply Chain

- Soaring inflation

- Skyrocketing energy prices

- Supply chain disruptions

- Lack of skilled workers

- Moving towards operational excellence in manufacturing companies

- Drawing the logistical structure: the blueprint in manufacturing companies

- Layers of complexity in manufacturing

- Bill of Materials – the document that lists the different products

- The 3 cornerstones of an effective manufacturing process

- The Master Production Plan (MPS)

- Materials planning (MRP)

- MRP 1 or inventory control system

- MRP 2 or production control system

- MRP 3 or resource planning system

- Which MRP is best for my company?

- Stocking index for semi-finished products

- Stocking index for raw materials and components

- The best recipe against uncertainty and risk: process optimisation

- Manufacturing supply chain FAQs

In a world rocked by relentless challenges, the manufacturing industry has been at the forefront of disruption. Rising raw material costs, surging energy prices, fluctuating interest rates, and a myriad of supply chain headaches have pushed manufacturers to their limits.

While we may have seen some respite from these market forces, the landscape remains uncertain. The economy is an unpredictable beast, capable of surprising us with unforeseen events and their cascading consequences. Who could have foreseen the seismic impact of the pandemic, or the geopolitical ripples caused by the Russian invasion of Ukraine? In this ever-changing world, the next major global event could be lurking just around the corner.

Manufacturing companies, acutely aware of these risks, have been diligently assessing their strategies to withstand the storm. In a recent study conducted by KPMG, which focused on manufacturers of consumer goods, top-level executives voiced their concerns loud and clear. To mitigate risk and secure a competitive edge in the face of this uncertainty, manufacturing companies must revolutionise their operations to tackle such things as:

Soaring inflation

In an era where prices seem to defy gravity, manufacturers find themselves grappling with a formidable challenge: the soaring cost of raw materials. Consequently, these businesses now find themselves at a crossroads, forced to make tough decisions to safeguard their bottom line.

As profit margins dwindle in the face of rising costs, manufacturers are left with a conundrum. Should they succumb to the pressures and accept weakened profitability? Or should they shift the burden to their valued customers, risking their loyalty?

The impact of these cost increases reverberates throughout industries. However, in the agrifood sector, everyone is feeling the pinch. According to Food Manufacturer, total input costs for food manufacturers were up 16.3% in the first four months of 2023 compared to the previous year. The story for consumers is equally as bleak.

In the United Kingdom, prices skyrocketed by a staggering 19.1% within a single year. Spanish consumers too have been stung with a 17.7% surge compared to the previous year.

Such jaw-dropping statistics serve as a stark reminder of the far-reaching consequences of price fluctuations, extending far beyond the boardroom and into the homes of individuals.

Skyrocketing energy prices

The war in Ukraine had a seismic impact on businesses around the globe. The surge in energy prices that followed sent shockwaves throughout European countries, presenting an unprecedented challenge that tested the mettle of manufacturers far and wide.

For industries heavily reliant on electricity, such as the steel manufacturing sector, the situation became a dire game of survival. The spike in energy costs dealt a crippling blow to profit margins, forcing some factories to face an agonizing decision: temporarily shut their doors or endure dwindling profits.

Supply chain disruptions

Another “classic” that has been a headache for all companies in the supply chain in recent years is continuous interruptions, becoming an ongoing headache for many businesses.

According to a KPMG study, 33% of directors have already diversified their supply base to mitigate risks, with an additional 27% planning to do so soon.

Lack of skilled workers

The scarcity of qualified personnel reverberates like an unwelcome echo through manufacturing HR departments. As highlighted in a recent Randstad study, by 2030, a staggering eight-million manufacturing roles will remain unfilled, simply due to a shortage of skilled workers.

But that’s not all—manufacturers must navigate a treacherous labyrinth of challenges. Fierce competition looms ominously, while customers, armed with heightened expectations, demand nothing short of excellence. For many, survival hinges on a delicate balancing act: maintaining unwavering quality standards while steadfastly ensuring customer value in the face of relentless inflationary pressures.

Moving towards operational excellence in manufacturing companies

The intricacies of logistics operations in manufacturing companies sets them apart from other players in the supply chain, such as distributors and retailers. Elements like Bills of Materials (BOM), Master Production Plans (MPS), and Material Planning (MRP) are unique to the manufacturing realm. It’s crucial to recognise that production companies not only manage the demand for finished products but also handle additional complexities, including semi-finished products and raw materials.

In this article, we delve into how manufacturers can retake control of the supply chain while managing these intricate factors. Throughout, we will explore some of the innovative strategies and transformative technologies that are revolutionizing the industry. From optimizing the supply chain and implementing automation to making data-driven decisions and embracing agile manufacturing principles, we will uncover the foundational elements that pave the way for sustained success in operational excellence.

Drawing the logistical structure: the blueprint in manufacturing companies

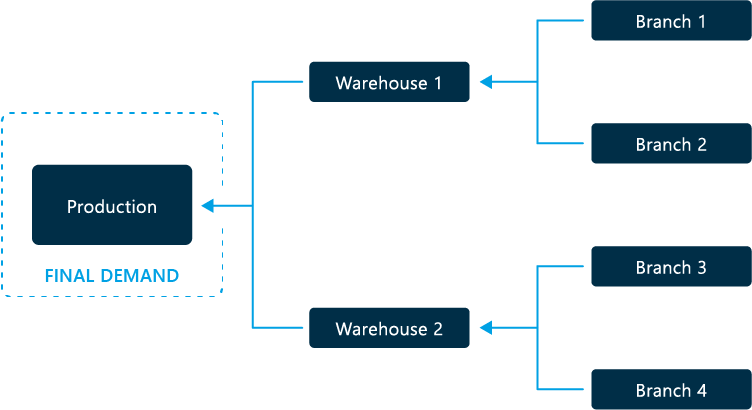

Before embarking on any improvement initiatives, it is essential to create comprehensive logistical blueprints that accurately represent the unique structure of your company. These blueprints serve as a visual representation of your logistical processes and will vary in their specifics for each organization.

When developing these blueprints, it is important to differentiate between two types of flows: the logistic flow, which outlines the direction goods follow within the supply chain, and the demand flow, which maps out the patterns of customer requirement. To illustrate, let’s consider an example of a manufacturing company that distributes its products to wholesalers, who then further disperse these products to other distributors or retailers.

These blueprints provide a clear understanding of the intricate flows within your supply chain. They serve as a valuable reference point for optimizing processes, identifying bottlenecks, and implementing targeted improvements.

In this case, we see how the flow of goods starts at the suppliers, who deliver raw materials to the manufacturer. It processes them into finished products that are then distributed throughout the logistics network.

Demand flows also circulate through this same network but in the opposite direction. It is precisely here that we find one of the main differences between manufacturing companies and the rest of the links in the supply chain. Consumption, starting with the end consumer and passing through the retailer and distributor, is what ends up influencing the quantities to be manufactured in the production centres.

Layers of complexity in manufacturing

Manufacturing companies distinguish themselves from retailers and distributors through their intricate management of diverse product types. Unlike their counterparts, manufacturers are tasked not only with forecasting demand for finished products but also with ensuring the timely and adequate supply of raw materials and semi-finished products required for production. Each product category possesses distinct characteristics, as outlined below:

Raw Materials or Components:

These are products that undergo transformation throughout the production process. Ultimately they become semi-finished goods and, eventually, fully assembled articles. For instance, let’s consider a remote control for a television. The raw materials for the remote control would be the rubber required for the buttons and copper for the electrical wiring. As for the television, its components would encompass metal for the bracket and plastics for the casing.

Semi-finished Products:

As an intermediary position within the manufacturing process, semi-finished products bridge between one or more raw materials and/or components and the finished product. To further illustrate, in the previous example, both the remote control and the television set would be classified as semi-finished products.

Finished Products:

These are objects ready for delivery to customers, requiring no further modifications or preparations for marketing. In the case of our example, the finished product encompasses the box containing the TV, the TV itself, the remote control, and the necessary cables.

Understanding the nuances and distinctions within these product levels is vital for ensuring an efficient manufacturing process. It allows for effective planning, seamless supply chain management, and the efficient delivery of high-quality products to customers.

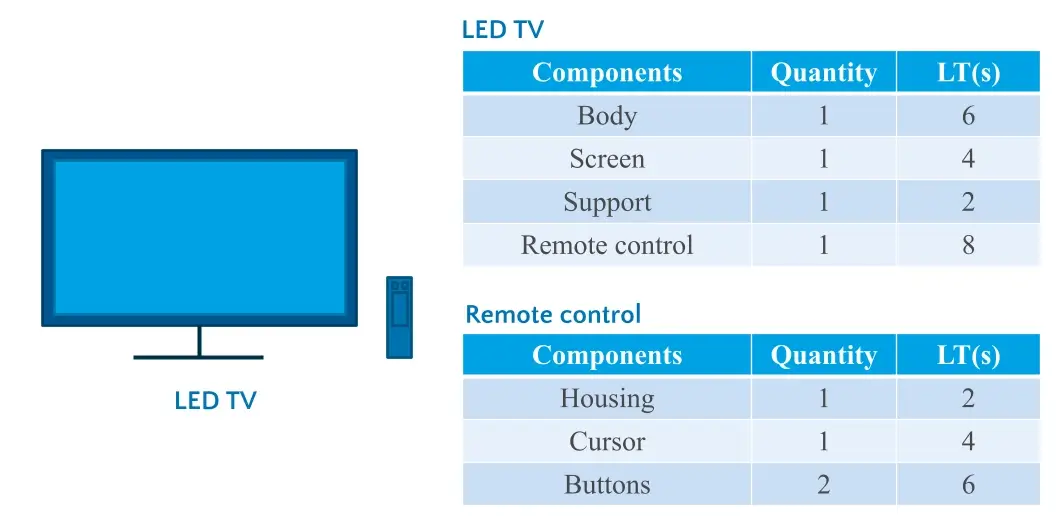

Bill of Materials – the document that lists the different products

And how do these various product types interrelate? The key lies in the Bill of Materials (BOM).

The Bill of Materials serves as a comprehensive list encompassing all the components, materials in progress, or items required for the production or assembly of a particular article. Creating an accurate BOM necessitates considering several crucial factors:

Quantities:

Determining the required quantities of each raw material, component, and semi-finished product necessary for the production of the finished product.

Lead Times:

Incorporating the lead times or manufacturing durations for each raw material, component, and semi-finished product, tracing their path until they culminate in the final finished product.

Validity:

Accounting for the validity or expiry dates associated with the raw materials, semi-finished products, and finished products, ensuring compliance with regulatory standards and maintaining product integrity.

The 3 cornerstones of an effective manufacturing process

In addition to grappling with three distinct product levels, manufacturing companies face unique supply chain processes that set them apart from distributors and retailers. To achieve operational excellence, it is crucial to have a firm grip on the following key processes:

Demand planning is a critical process that involves analysing historical demand patterns and enriching them with relevant information to create a comprehensive picture of future demand. This enables better decision-making. The accuracy of the forecast serves as the cornerstone for optimising the operational flows that follow.

At this stage, we encounter a common thread shared across all supply chain links: the significance of understanding the level of customer demand. However, it is important to remember that within the manufacturing realm, we differentiate between two types of demand:

Independent Demand:

This type of demand is driven by the end customer’s consumption, whether it pertains to finished products or raw materials. For instance, a bread manufacturer uses flour to produce the final product, but there may also be instances where the manufacturer sells flour directly to customers.

Dependent Demand:

Dependent demand arises from the requirements generated by the demand for the final finished product. In practical terms, once we have predicted the demand for the final product, we must translate this data into the necessary quantities and timings of semi-finished products and raw materials. This ensures the ability to meet customer needs efficiently.

The Master Production Plan (MPS)

The Master Production Plan (MPS) plays a vital role in achieving operational excellence by facilitating medium-term capacity planning to meet both logistical (operational constraints) and financial (economic constraints) demands.

Typically, the MPS is developed with a 12-month horizon, employing a weekly granularity to establish a close alignment between commercial requirements and operational resources. For instance, during periods of peak demand, the projected needs may surpass the production capacity. Having this information in advance empowers manufacturers to explore remedies, such as proactively adjusting production schedules if feasible.

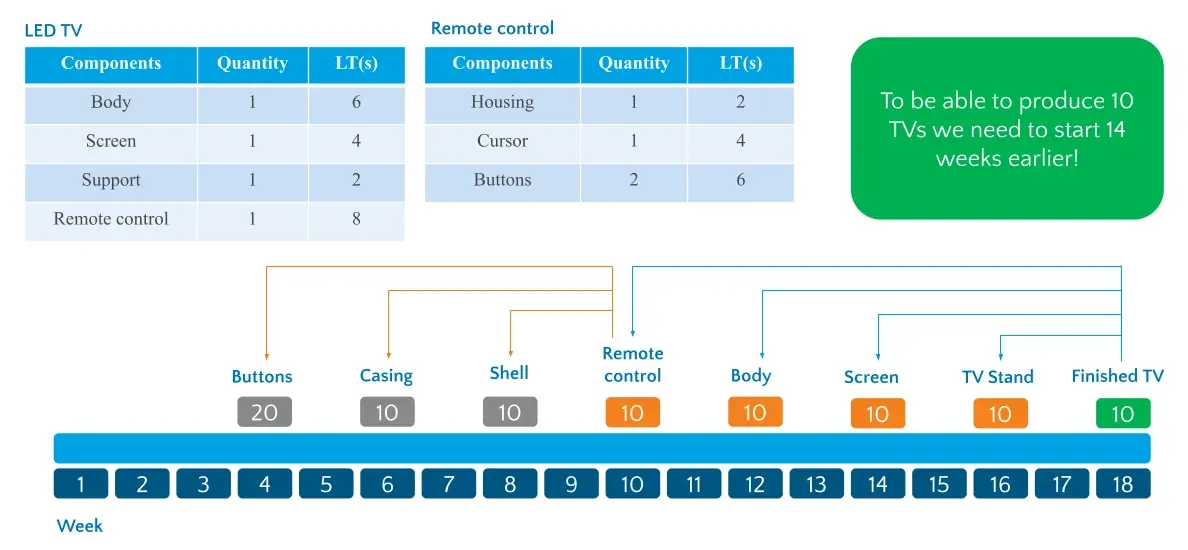

Consider a practical example: Through accurate forecasting, we determine that 10 televisions will be required in week 18. Leveraging this data and referencing the materials list depicted in the accompanying image, we can discern the timeframes and quantities of the components needed to manufacture the final product.

Let’s start with the forecast of the demand for the finished product. In this case, thanks to our accurate forecasts, we know that the demand for televisions in week 18 will be 10 units. Based on this data, and the lists of materials that you can see in the image below, we can anticipate the times and quantities required to produce the final article.

In this way, we know that 10 TV stands will be needed in week 16, 10 bodies in week 12 and 20 buttons in week 4, allowing us to match customer demand with operational, capacity and provisioning needs.

Consequently, we ascertain that 10 shells will be necessary in week 8, 10 bodies in week 12, and 20 buttons in week 4. This level of insight allows us to align customer demand with operational capabilities, ensuring adequate capacity and provisioning requirements are met.

To ensure coherence and effectiveness, achieving a high level of accuracy in demand forecasting is of the utmost importance. This imperative drives the operations department to establish what is referred to as “frozen periods.” Frozen periods, in this context, denote specific timeframes during which the commercial department is prohibited from introducing new promotions or events: actions that could place additional pressure on an already stretched production line.

It is crucial to comprehend these frozen periods within the broader context of an annual plan. These periods do not signify the outright cancellation of promotions or events but rather a slight adjustment in their scheduling. As a result, promotions or events may be shifted by a few weeks to align with the overall operational strategy.

Materials planning (MRP)

Once the MPS has been developed, the next step is to create the MRP. By MRP, we mean the planning and inventory control of a company’s demand-dependent materials for the production of finished items. Therefore, this ‘bill of materials’ must allow us to identify the components and semi-finished products that we need, both in time and quantity.

Here, we can distinguish 3 different types of MRP:

MRP 1 or inventory control system

This MRP does not take into account the production capacity, hence the name infinite MRP. This type of MRP is based on translating the dependent demand by creating production orders for raw materials and semi-finished products.

It takes into account both quantity and timing requirements but does not cross-reference this data with production capacity. For many companies, this level of MRP is sufficient, as the challenge most organisations face is not to do with production capacity. Instead, their problem is that they do not have a robust demand planning process in place resulting in the production of the wrong items in the wrong batch sizes.

MRP 2 or production control system

Although similar in principle to MRP1, MRP2 or production control systems take into account production capacities.

MRP 3 or resource planning system

MRP 3 is the most complete system as it takes into consideration the operational production capacities and also the personnel resources necessary to carry out the manufacturing process. Therefore, the control over the production process is complete.

Which MRP is best for my company?

This is a common question for many companies. At this point, it is worth considering the production capacity of your company and the complexity of its manufacturing process.

In terms of production capacity, as we mentioned earlier, some companies believe they do not have enough when their problem is a direct consequence of poor quality demand plans and inefficiencies in the production processes.

Equally, in terms of production complexity, a company with relatively simple manufacturing processes may not benefit too much from implementing MRP 3.

Optimisation of the assortment

Effective assortment management is as important in manufacturing as in distribution and retail and distribution environments.

Now the question is: ‘What is special about assortment management in manufacturing?’ In essence, the challenge here is that we do not only manage finished products but also semi-finished products and raw materials that are needed for production.

So, what products should you have in stock? On the one hand, we must have items that allow us to be sufficiently agile to deal with unforeseen events, but, at the same time, we must bear in mind that investing in stock entails an opportunity cost and a risk of obsolescence. The objective is to find the optimum assortment that allows us to deal with market fluctuations, but without falling into excess.

So what aspects should you take into account?

Keeping a close eye on demand volatility

Care must be taken with those references that may have a sudden peak in demand, due to seasonality or some unforeseen event, and then quickly cease to have a market.

Another potential problem is that if we have been the first to introduce a product in the market and it has been very well accepted, it is very likely that competitors will quickly appear offering a similar item with aggressive price offers to steal our customers.

Optimise the decoupling point situation

Where to set the decoupling point is of vital importance. Getting this point right will directly influence the degree of success in assortment management and all that derives from it: level of service, customer satisfaction and the company’s turnover.

In this sense, the further away the decoupling point is from the end customer, the more flexibility we should have to avoid obsolescence. This is because raw materials and semi-finished products are often shared to produce different end products. A finished product, on the other hand, can no longer be modified.

Establish a stocking index

To decide whether to incorporate or maintain a product in our inventory, we can use the so-called stocking index. This index allows us to assign a valuation to each product based on different criteria and, depending on the result, we decide whether the item should be stocked or not.

In the case of manufacturing companies, we will need 3 stocking indexes; one for each type of product. Let’s look at each of them in a little more detail.

Stocking index for the finished product

For this type of product, we will measure the time it takes to achieve the final conversion, the turnover it brings, if there are unique customers and if the most important customers consume this product. Based on this analysis, we will decide whether the item will be managed against ‘stock’ or ‘to order’.

| Criterion | Score | Limit | Measurement | Result |

|---|---|---|---|---|

| Manufacturing Lead Time | 40 | > 8h | 5h | 0 |

| Invoicing | 20 | > £300/week | > £200/week | 0 |

| Batchsize Vs. EOQ | 10 | > 15% differ. | 35% | 0 |

| No. Unique Customers | 5 | > 5 | 6 | 5 |

| No. A-Customers | 7 | > 3 | 4 | 7 |

| Strategic Article | 10 | Yes | Yes | 10 |

| GMROI (margin x turnover) | 4 | > 120% | 80% | 0 |

| Product Ranking | 5 | Top 50 | In Top 50 | 4 |

| Total Score | 100 | 26 |

| Score 0 – 29 | Set to Non-Stocked ✔️ |

| Score 39 – 49 | To be defined – Further analysis required |

| Score 50 – 100 | Stocked Item |

Stocking index for semi-finished products

In this case, we will pay attention to the versatility of the semi-finished article: the number of finished products it can be converted into, whether or not it has independent demand, whether it has raw materials with very long lead times or whether the finished products it is converted into are strategic for the company.

| Criterion | Score | Limit | Measurement | Result |

|---|---|---|---|---|

| # of Products Used Within | 40 | > 7 | 9 | 40 |

| Independent Demand | 20 | Yes | Yes | 20 |

| Manufacturing Leadtime | 20 | > 8h | 10h | 20 |

| Raw Materials with LT > 1 month | 20 | Yes | No | 0 |

| Total Score | 100 | 80 |

| Score 50 – 100 | Stocked Item ✔️ |

| Score 39 – 49 | To be Defined – Further analysis required |

| Score 0 – 29 | Set to Non-Stocked |

Stocking index for raw materials and components

As far as raw materials and components are concerned, we should pay attention to the Bill of Materials in which they are present, the delivery time of the supplier, the reliability of the supplier that produces them and whether or not they have independent invoicing.

| Criterion | Score | Limit | Measurement | Result |

|---|---|---|---|---|

| # BOMs in item which is located | 15 | > 7 | 9 | 15 |

| Independent Demand | 25 | Yes | Yes | 25 |

| Supplier delivery time | 40 | > 7 days | 2 days | 0 |

| Supplier Reliability | 10 | in TOP 20 | No | 10 |

| Total Score | 85 | 55 |

| Score 50 – 100 | Stocked Item ✔️ |

| Score 39 – 49 | To be defined – Further analysis required |

| Score 0 – 29 | Non-Stocked |