In today’s complex environment, there are a number of challenges that threaten business performance. With the need to survive in a highly uncertain and unpredictable environment, increasingly fierce competition and constant disruptions in the global supply chain are just some of the difficulties most companies face.

It is precisely at these difficult times that it is wise to turn to people you trust. In your personal life these people would most likely be your family or friends. In your professional life, these “trusted people” are your suppliers, and collaborating with them is one of the keyways to mitigate your risks.

Imagine that there is a shortage of the main raw material used to make a key product in your range. Wouldn’t it be beneficial if your supplier could alert you as early as possible to the impending shortage so that you can adjust your planning? Similarly, if you launch a promotion, your supplier would also appreciate as much advance notice as possible.

Smooth communication is one of the pillars of efficient supplier relationship management. But there are more.

Hence, in this article, we will delve into the topic of supplier relationship management, exploring:

- Supplier selection and contract negotiation

- Supplier contract management

- EOQ in supplier management

- Supplier performance assessment

Steps in supplier management

Although it may seem obvious, the first step to effective supplier relationship management is to have the supplier in the first place. To do this, we must start by selecting the partner that best suits our needs.

Supplier selection

The selection process consists of a series of stages, which will depend on the criticality and value of the products to be acquired.

The steps to be followed in the selection of suppliers are as follows:

Search and pre-selection of suppliers

Just as when we are going to buy a product for ourselves, we evaluate different options, when it comes to making professional purchases, we make a professional purchasing decision, we must also search for and compare possible suppliers

We should use a variety of sources, such as specialised newspapers/magazines, internet searches, radio and television news, and recommendations from people we trust, including other suppliers, clients or contacts we’ve made at trade fairs and professional exhibitions. You can also go to business associations, where they usually have categorised lists of suppliers by speciality.

Determine the selection criteria

The second stage, which can be carried out alongside the first, involves defining the selection criteria.

Some of the most commonly-used criteria are related to:

- Technical and functional characteristics: The product must meet the requirements of your company.

- Quality: Durability and resistance of the product provided by the supplier.

- Price: Although this is easy to compare, it is important to consider all elements of the product acquisition. This is known as the total cost of ownership. What is the point of having a very cheap car if it spends all day in the garage, or if the cost of servicing it is very high? You have to keep in mind all the components of the price as that is what determines the complexity of price comparison

- Delivery times: This is a very relevant element, especially in competitive environments. It is not only about getting it there, but also about getting it to market before anyone else.

- Method of payment: This will have a major impact on the company’s finances and is therefore an important element to consider.

- After-sales service: This is crucial when it comes to durable items or items with a long lifecycle. In these cases, you should always consider how you will solve any potential future problems.

- Other considerations: This can include factors such as the supplier’s reputation, warranty, experience, sustainability policies, etc.

Obtaining information from suppliers

The next step is to collect information from potential suppliers to enable you to compare all the criteria previously selected. To do this, we can use Google, public information – for example, the commercial register – or the supplier’s own website. Similarly, we can use RFQs or RFIs (Requests for Quotation and Requests For Information). This research, if carried out correctly, will allow us to find out:

- The company’s track record

- Your financial status

- The opinions of your customers

- Your market positioning

Evaluation of suppliers

Once the research has been carried out, it’s time to evaluate it according to the criteria you have determined.

As can be seen in the table below, we will first weigh up the criteria to be taken into account, and then assess each potential supplier against each individual criterion. In this way, we will obtain a final assessment.

| Criteria | Weight (%) | Supp. 1 | Supp. 2 | Supp. 3 |

|---|---|---|---|---|

| Post Sales Service | 20% | 1,60 | 2.75 | 2.80 |

| Delivery Times | 15% | 2,58 | 2,93 | 2,90 |

| Quality | 15% | 2,70 | 2,30 | 2,40 |

| Payment Method | 15% | 2,85 | 2,90 | 2,83 |

| Price | 10% | 2,50 | 3,00 | 3,00 |

| Others | 25% | 2,29 | 2,74 | 2,76 |

| Total | 100% | 2,36 | 2,75 | 2,77 |

We must include the criterion of technical and functional characteristics and give it at least 30%. Distribute the weights up to 100%.

Based on this assessment, we will move on to the fifth and final step of the selection process.

Procurement and negotiation with the supplier

The final negotiation is designed to establish a lasting and productive relationship with the supplier. This is key to:

- Gauging each party’s position and your strengths vis-à-vis the supplier

- Defining a strategy that specifies which concessions are admissible, and which are not, at each stage of the negotiation.

And I recommend not ruling out the other suppliers until you have signed up with the front runner. Supplier relationship management is as much about managing your current supply chain partners as it is nurturing suppliers for the future.

Management supplier contracts

When you draw up your contract, you can agree whether to utilise either individual purchase orders or open purchase orders that have a coverage period and a minimum order quantity.

The following parameters should be taken into account in order to establish the amounts and the contract period:

- Demand Forecasting

- Purchase forecast until the end of the contract

- Coverage with existing stock

- Trend

- Product life cycle

- Product recalls

- Sources of supply

- Price discounts vs cost of ownership

Once the contract is closed, it’s essential to track its performance to establish: whether the stated quantity will be exceeded; whether the agreement will not be fulfilled because there has been less demand than expected; or whether to launch a procurement process before the end of the contract period.

This will enable you to know:

- whether the contracted amount falls short of or exceeds your requirements

- whether the contract will expire because you have exhausted all of the quantities

Taking all of these points into account will enable you to manage the contract in an appropriate way.

EOQ in supplier management

We will now analyse the order quantity and its relationship to the Economic Order Quantity.

Open contracts and isolated orders require you to ask yourself the following three questions:

- What am I going to buy?

- When is the right time to place the order?

- How much should I buy?

We will now focus on the last point. Once we know what to stock and when to stock it, the question is, how much do I order? Do I buy enough to satisfy the demand for the whole year, or do I buy one unit at a time?

The EOQ will give you the answer to this difficult question, and it will ensure that the quantity chosen is the most beneficial.

Let’s start by looking at the difference between the Minimum Purchase Quantity (MPQ) and the Economic Order Quantity (EOQ):

- MPQ is the minimum order quantity agreed with the supplier.

- EOQ is the optimal theoretical quantity.

How to find the EOQ

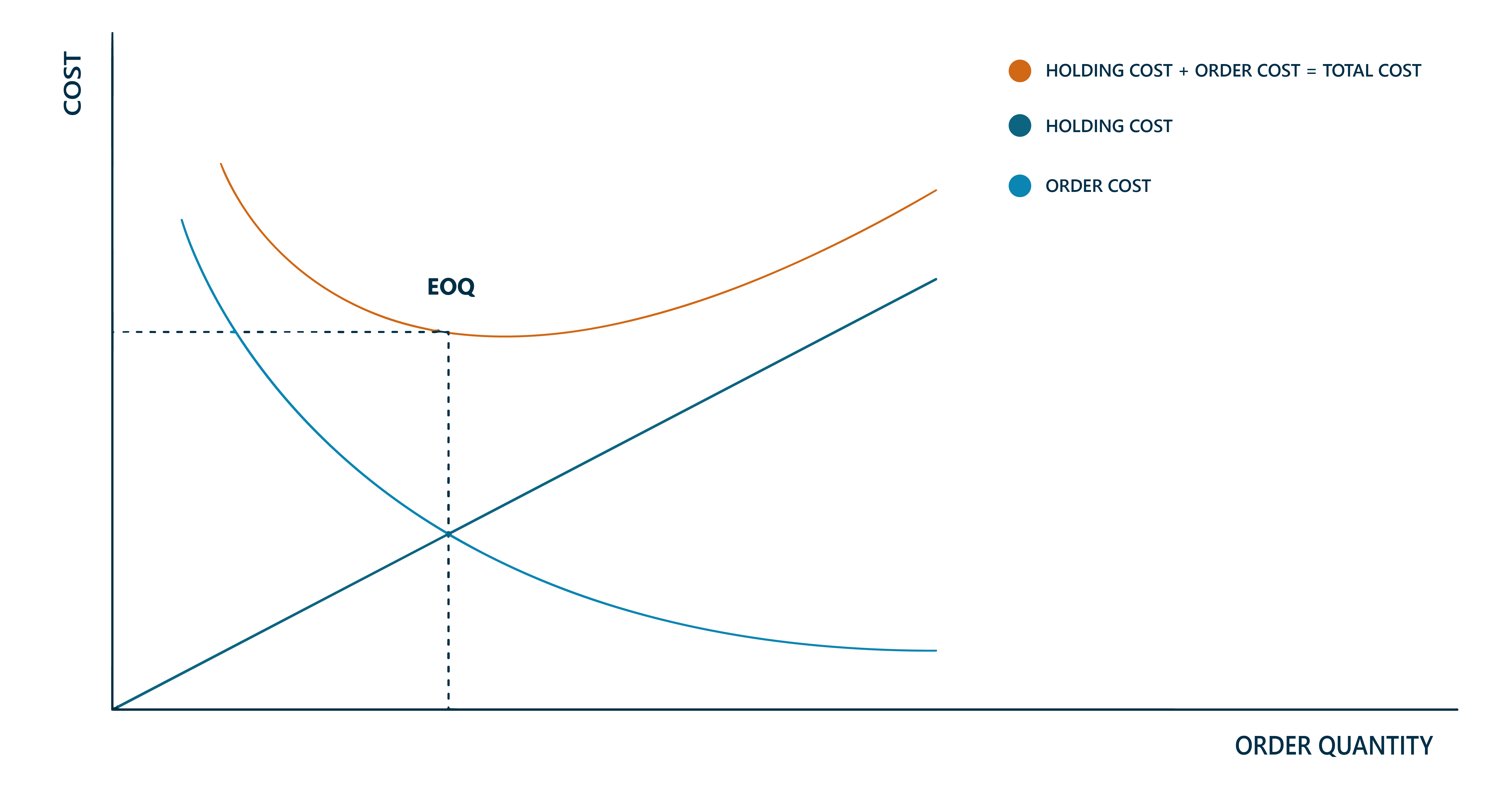

As mentioned above, the EOQ is the order quantity at which we minimise costs, and to calculate it, the costs of holding stock and the costs of placing an order must be taken into account.

On a practical level, if we are at the beginning of the year and we need 360 units for the whole period, we could either place an order for 360 units, an order for 30 units per month or an order for one unit per day.

If you choose to buy all 360 units at once, you’ll have a small order cost – as it will be a single order – but you’ll have a very high inventory cost, as you’ll have to hold a very high stock level – 180 units on average – all year long.

At the opposite extreme, if I buy one unit per day, my inventory cost will be close to zero, but my ordering cost will be very high as I will have to place one order per day.

Let’s break that down into a little more detail.

Holding costs

Although it’s obvious, some companies forget that warehousing is not free. Even when we’re told, “Yes, but the warehouse is mine and it’s paid for”, we’ll see that having a full warehouse is not the same as having an empty one. So I must stress this point: warehousing is not free even when the warehouse is your own.

When we talk about stock holding costs, we can differentiate between two types:

Costs associated with capital

More specifically, this refers to the costs associated with money invested in buying stock. Let’s look at the two most common cases.

Interests

Often, to be able to afford the investment, we have to apply for a loan. This has an associated interest (lower or higher depending on the time of year), but it’s interest that will have to be paid and therefore needs to be taken into account.

Opportunity cost

If I choose to use my capital to buy stock, I am losing the opportunity to invest it in other areas of the business.

Non-capital costs

These are costs that have to be borne because the goods are in stock and, should they not be in stock, no costs would be incurred.

Storage

When the warehouse is owned by a third party, and we have to pay rent, this cost is more obvious. But it also applies when the warehouse is our own – for example, the cost of utilities at the location, such as electricity or water.

Obsolescence

These are the costs associated with the obsolescence of products due to the fact that they depreciate in value as their useful lifecycle progresses.

Ordering costs

These are the costs incurred each time I place an order. From the time I establish the need until the product is on my shelves, there are a number of processes that require effort and money.

The components of the ordering cost are the costs relating to the processing of orders. Some of the most relevant are:

- Transport costs.

- Personnel costs (both administrative personnel and the warehouse personnel who receive, quality control and register the stock in the system).

- Cost of the systems (for order calculation, managing delivery notes, picking, etc).

Difficulties in calculating the EOQ

Unfortunately, all these calculations may have certain issues or constraints associated with them, for example, the need to buy in logistical units, eg boxes, layers, pallets, or trucks. All this can affect our calculations.

As we can see in the graph below, the curve is flat, but we must take these units into account to complete the EOQ calculation. If there are changes in the logistics units of the supplier, we must know this in order to adjust the EOQ.

On the other hand, you need to take into account volume price discounts. We’re not talking about one-off offers but about volume discounts on our official rates.

The analysis of the EOQ versus the MPQ will give us cases in which EOQ<MPQ and other cases where EOQ >MPQ. In fact, we should always compare these minimum purchase quantities (the MPQ) with the optimal purchases (EOQ). The justification, “We buy a lot because the supplier forces us to” is not always true.

When the main differences between what is optimal, and what is actually being purchased come to light, we often get answers such as “I have always bought this way”, and “That‘s what’s been negotiated with the supplier”, etc. However, when we dig a little deeper, we often discover that the negotiation was made years ago and hasn’t been reviewed since then.

In addition, it’s often the case that the MPQs suppliers give us will always be over and above what’s optimal for our interests. For those of you who think like this,I’d encourage you to do your own analysis, and you may well be surprised. There are many occasions when you’re buying an amount that’s below the optimum, thinking that it’s in your best interests. This usually happens because you’re only taking into account the costs of possession, forgetting about the costs of ordering. So it’s very important to keep both costs in mind.

Common supplier constraints due to logistical conditions

Once we’ve analysed the EOQ, we’ll move on to analysing the quantities to be purchased at the supplier’s full product portfolio level, and how to optimise purchasing based on order size and timing. We are often faced with supplier constraints, logistical conditions and price optimisation considerations when we’re about to place an order.

These conditions can be at the reference level or at the supplier level. At the reference level, we have already analysed the possible restriction of having to buy in full boxes, or in pallet layers, or as a full pallet. This restriction can also apply at the supplier’s full portfolio level.

If you’re a retail or wholesale professional, you’ll be familiar with the need to buy in full truckloads or you’ll be very aware of the need to buy full containers in the Far East to avoid “transporting air”.

Another possible restriction is having to place an order for a minimum amount in euros so that the supplier does not charge us for postage (which is a disguised discount).

In all these cases, it’s important to fulfil the orders in an intelligent way, by filling the containers with the goods that we’ll need to restock soon.

Common adjustments to change the target order release dates

You may have a promotion coming up, which will force you to modify and rethink the product launch date. In this case, can you wait until the promotion period to place the order, or should you bring forward the order that’s to be placed after the promotion period? It is important to have this information in order to place orders efficiently.

On the other hand, it may be that your warehouse capacity is saturated, so you should change your order dates so as not to overwhelm the reception process. And in an environment of promotions and discounts such as the one we’re experiencing today, it’s important to keep in mind possible volume discount ranges to adapt your order to the quantities that provide a greater discount, without saturating your warehouses with merchandise.

Two-way communication with the supplier

It’s also important to do your part to ensure that the supplier can serve you well. Sharing your vision with them can be key to your success. And communication is key for effective supplier relationship management.

If you already have visibility of your future stock needs, why not share this information with them? If we know the orders we are going to place and even the full estimated demand for a whole year, why not give them this information in advance? There are times when suppliers fail us simply because they were not expecting our orders. And in logistics, the unexpected is the last thing we need. We have enough unforeseen events in our supply chains, so sharing our estimates will help the people we want to help us. Quid pro quo.

However, always make it clear to the supplier that these are estimates, and that the final numbers will come with the confirmed orders.

Evaluation of our supplier’s performance

This is the last phase of supplier relationship management.

Let’s say we have already selected our suppliers, we have contracted them, we have placed the orders, we have shared the information we have with them … and now it’s their turn to deliver the orders in an optimal way.

Ideally this should be the case, but it’s important to put in place appropriate mechanisms to monitor the supplier’s performance.

First of all, this performance evaluation cannot be based on anecdotal events, but must be based on complete, concrete and truthful data. In this sense, the indicators we take into consideration should be:

- Measured results of repeated processes or actions

- Spoken in a language that is widely understood by the organisation.

- Measurable in a simple way. If this is not the case, find a simpler alternative.

- Truthful and correct. It does not help us to deceive

- Aligned with the company’s global KPIs.

Which KPIs can we use in the evaluation of suppliers?

First and foremost we should consider the quality indicators of the product supplied to us, such as rejected units in any part of the process, specific quality parameters, etc.

When it comes to logistical parameters, it’s important to mention the OTIF (On Time In Full). This KPI measures how many orders have been delivered on schedule and in the agreed quantity.

If we take the theoretical example of a procurement process where orders are placed with a delivery time of 7 days, (forgetting about possible safety stock), if the supplier is 7 days late, we have a stockout for that number of days. This will affect our service level and will upset our customers. In this event, it’s important to ask the question: should my system take into account the theoretical lead time, or should it be the historical lead time? My advice is to look at the actual details and talk to the supplier to see what’s going on.

And why is it important to analyse what’s really happening? Because maybe the problem is our own, with slow unloading or slow goods registration processes causing delays. By doing this, we’re able to recognise that we should not only consider the lead time of the supplier, but also every single process from the time the order is placed until the material is available at our premises.

Supplier relationship management: some final thoughts

To sum up, let’s draw some brief conclusions: what practical solutions could you put in place as of tomorrow to ensure more effective supplier relationship management?

- Start by questioning your most problematic suppliers.

- In the analysis of purchase quantities, focus on those that have a higher unit cost and make a greater contribution to your profit margin. Focus on the ABC analysis of your assortment to set priorities.

- For order management, set clear rules for the placing of orders.

- Work with your supplier in a collaborative way.

- When evaluating suppliers, set one or two KPIs – at most – and consider not only the problems the supplier may have, but also the problems you may observe in your own company.

Supplier relationship management

What is supplier relationship management?

Supplier relationship management is a process that involves the selection, contracting, procurement process and active evaluation of a company’s suppliers. The objective is to ensure that suppliers meet agreed quality, cost and lead time standards, as well as to improve collaboration to optimise operations.

How can cooperation with suppliers be optimised?

Clear and transparent communication is essential to optimise collaboration with suppliers. Defining mutual expectations and goals from the outset helps to align objectives. Implementing efficient supply chain management systems, sharing relevant information and providing constructive feedback all contribute to effective collaboration. Establishing performance measures and conducting regular supplier evaluations also helps to identify areas for improvement and strengthen long-term relationships.

What are the keys to negotiating with suppliers?

Negotiating effectively with suppliers depends on a number of factors. Firstly, research and understand the market to obtain information on prices and conditions in order to set standards. Clearly define the objectives and limits of the negotiation, and seek solutions that benefit both parties.

What is the role of EOQ in supplier management?

EOQ (Economic Order Quantity) helps determine the optimal quantity of products a company should order from its supplier to minimise total inventory and ordering costs. EOQ provides an analytical basis for making informed decisions on how to source from suppliers in a cost-effective and efficient manner.