Overview

Integrating Sales & Operations Planning (S&OP) and Financial Planning & Analysis (FP&A) is necessary for success, as operational decisions have financial impacts. This integration aligns objectives, improves cost and revenue forecasting, aligns budgets, and uses inventory control to boost key financial metrics like cash flow and ROCE, leading to better profitability.

Sales & Operations Planning (S&OP) is traditionally viewed as a supply chain function, focused on balancing supply and demand, managing inventory and ensuring operational efficiency. But in reality, S&OP increasingly overlaps with Financial Planning & Analysis (FP&A).

As businesses navigate more volatility—supply chain disruptions, inflation, shifting consumer demands—S&OP is becoming a more strategic function, one that increasingly demands tight collaboration with Financial Planning & Analysis (FP&A) teams. Why? Because every operations decision today has a financial consequence tomorrow.

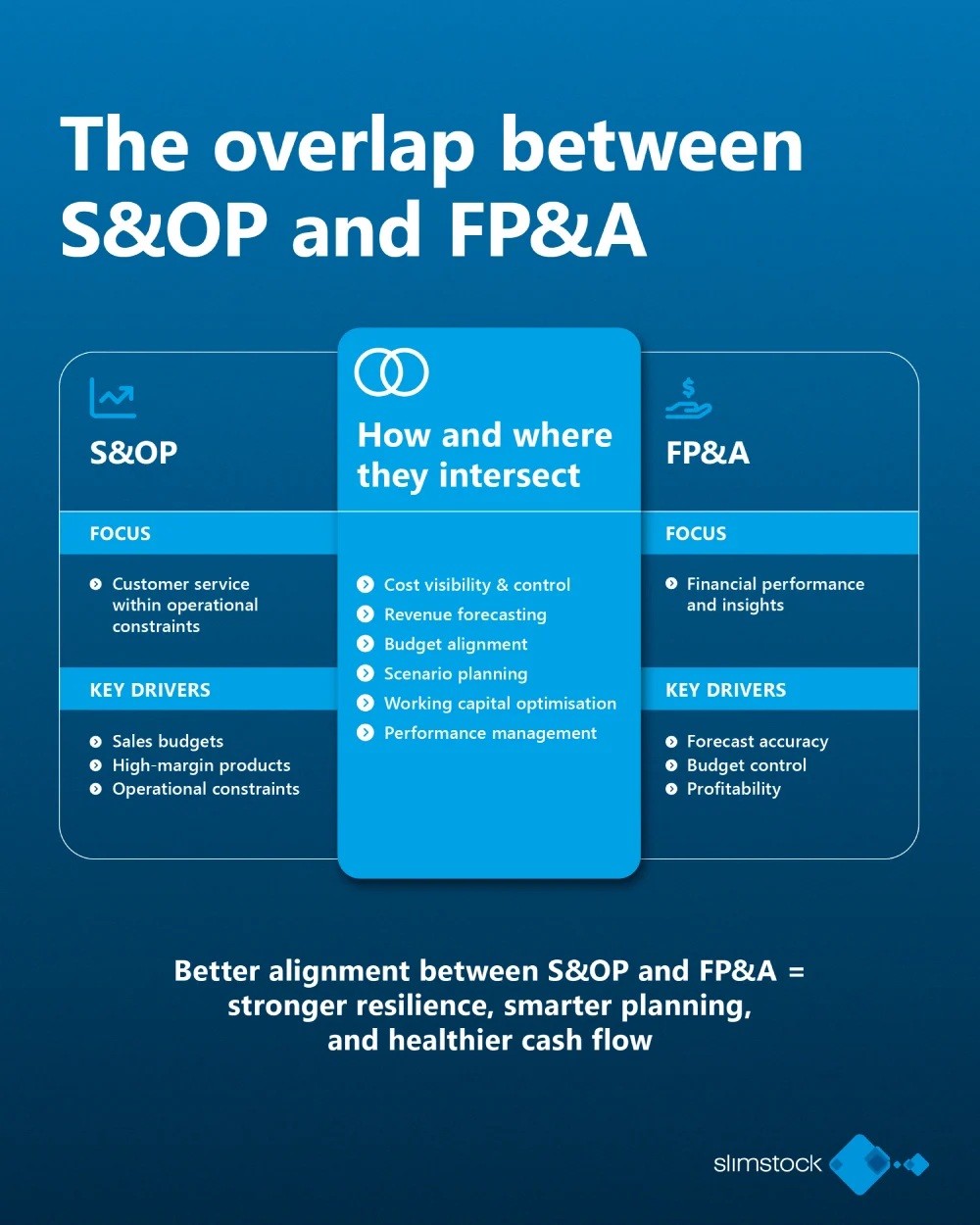

The overlap between S&OP and FP&A

S&OP and FP&A share a common goal: aligning operational plans with financial objectives. S&OP, however, is focused on reaching a certain customer service within operational constraints. A large portion is dedicated to finding opportunities to meet sales budgets, prioritising high-margin products and solving operational constraints. FP&A’s goal is to drive insights into the financial performance of the business.

In essence, FP&A should use a lot of inputs from the S&OP process and vice versa. Here’s how and where they intersect:

Cost visibility and control

S&OP decisions directly impact procurement, production, logistics, and inventory costs—all of which are key inputs in FP&A models.

Revenue forecasting

Demand planning in S&OP feeds into revenue projections, enabling FP&A teams to build more accurate financial forecasts.

Budget alignment

Supply chain budgets (e.g. for transportation, warehousing and inventory) must align with broader financial budgets managed by FP&A. Supply chain teams are also able to share inventory projections for FP&A budgets.

Scenario planning

Both functions rely on scenario modeling, S&OP for supply-demand shifts, FP&A for financial impacts. Integrated planning ensures consistency across both.

Working capital optimisation

Inventory levels, payment terms and production cycles managed in S&OP directly affect working capital, a key FP&A metric.

Performance management

S&OP KPIs (like forecast accuracy, fill rate and inventory turns) are increasingly tied to financial KPIs (like gross margin, ROCE, and EBITDA).

Looking at the above, many inputs and outputs of the two processes are shared and affect each other. Given the volatility and uncertainty of business in the last few years, S&OP and FP&A should be much closer than they have been in the past. Many cash constraints can be solved through better planning.

How inventory control supports financial health

Inventory is often the largest asset on a company’s balance sheet, and one of the most powerful levers for improving financial performance. By incorporating finance into S&OP, this asset can be managed much better. Here’s how supply chain teams can use inventory control to support financial KPI’s:

Working capital efficiency

Supply chain planning teams can assist finance by reducing excess stock to free up cash, which improves liquidity and reduces the need for external financing.

Cash flow improvement

Inventory locks in tremendous amounts of cash. Supply chain planning teams can implement lean inventory strategies (e.g. JIT, demand-driven replenishment, reducing order and batch sizes) to reduce holding costs and accelerate cash conversion cycles. However, this can come with increased operational expenses, such as labour or freight.

Return on capital employed (ROCE)

ROCE is arguably a business’s most important performance indicator. For wholesalers and distributors, most capital is tied up to inventory, meaning reducing inventory will have a big effect on ROCE as capital employed is lowered significantly. This can increase attractiveness to investors and shareholders.

Conclusion: a call for integrated planning

S&OP and FP&A should no longer be siloed disciplines. The most successful organizations treat them as two sides of the same coin, integrating operational and financial planning will be key to increas optimal decision making, and increase profitability.

By recognising the financial implications of supply chain decisions—and vice versa—companies can unlock new levels of performance.