Table of contents

Table of contents- How to Start Creating Your CSRD Report: The Importance of Double Materiality Assessment

- The Year Before: Preparation Is Key

- What Is Double Materiality?

- Example: Understanding Double Materiality

- Steps for Conducting the Double Materiality Assessment

- The Benefits of Double Materiality

- Conclusion: Setting Yourself Up for Success

Overview

The first critical step in preparing a Corporate Sustainability Reporting Directive (CSRD) report is conducting a Double Materiality Assessment. This assessment determines which ESG topics are material and must be reported by evaluating two perspectives: the ‘inside-out’ impact a company has on society/environment and the ‘outside-in’ impact that environmental/social factors have on the company’s business.

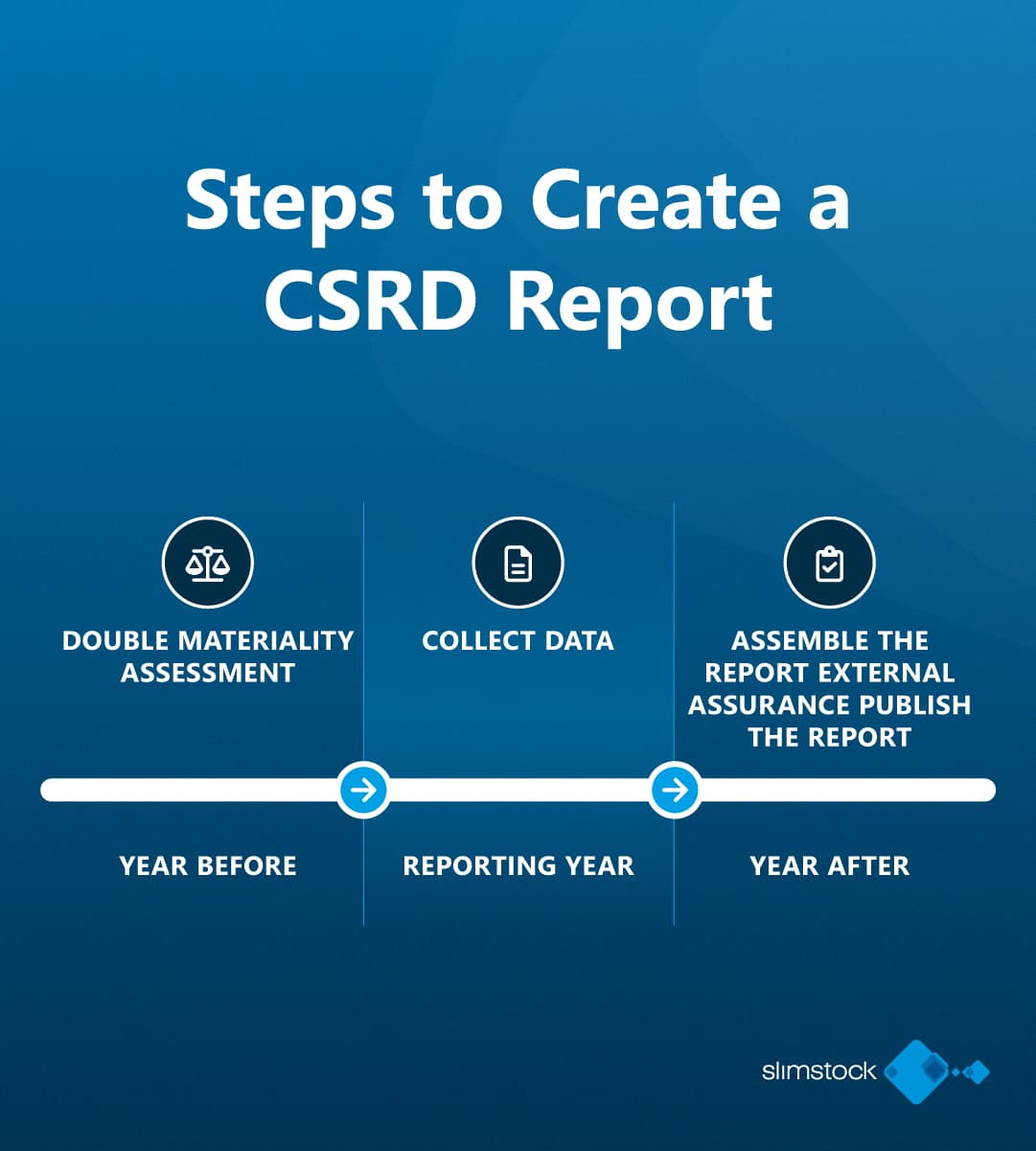

Creating a comprehensive and impactful sustainability report under the Corporate Sustainability Reporting Directive (CSRD) is no small task. For companies aiming to deliver their first report in 2025, the groundwork must begin at least two years prior to the report’s due date. The bulk of the effort is not in the financial year the report covers but in the years leading up to and following that year, especially during the preparation phase and when compiling the report itself.

In this second part of our CSRD series, we’ll guide you through the essential double materiality assessment, which should be carried out before the financial year even begins. This critical step helps you determine which sustainability topics are relevant to your business and must be reported.

The Year Before: Preparation Is Key

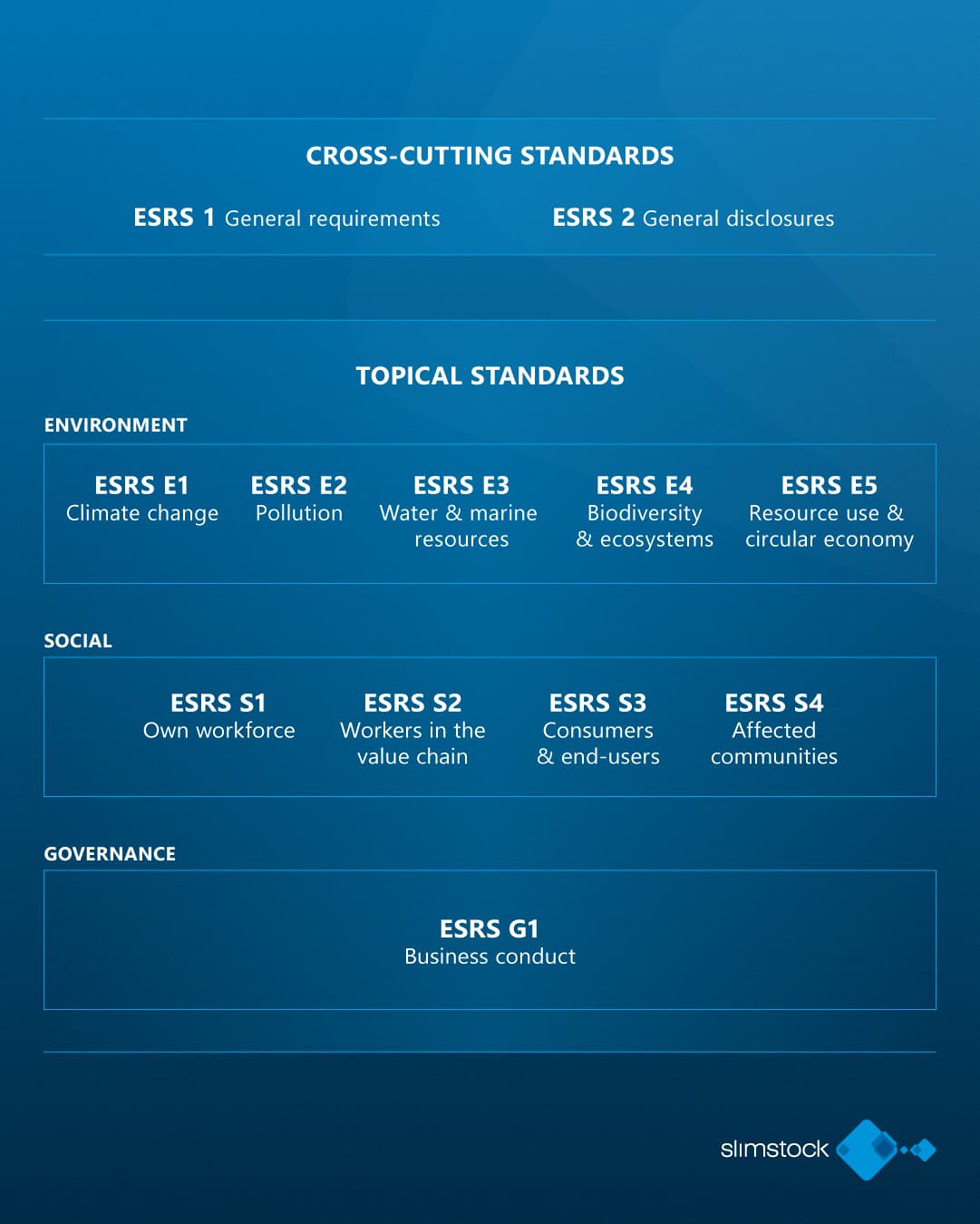

The process of CSRD reporting is a significant undertaking, and there’s much to prepare for. The European Sustainability Reporting Standard (ESRS) provides the detailed framework for what companies need to report. At a glance, this document spans nearly 300 pages of guidelines, and it includes over 80 disclosure requirements across a wide range of sustainability topics. To give you a sense of scale, this equates to more than 1,100 individual data points that need to be considered.

However, don’t let the sheer volume of data overwhelm you. The good news is that not every company will need to report on every single one of these data points. The key to narrowing down what to report on lies in your double materiality assessment.

What Is Double Materiality?

The double materiality assessment is the first crucial step in your CSRD reporting process. It helps you decide which ESG topics are material to your company and should be disclosed. Essentially, you need to assess the inside-out and outside-in perspectives:

- Inside-out: Does your company have a material impact on the environment or society?

- Outside-in: Do environmental or social factors have a material impact on your company?

This dual approach is the foundation of the “double materiality” concept.

Example: Understanding Double Materiality

To illustrate how the double materiality assessment works, imagine you are an orange farmer in Spain. You use pesticides, which can negatively impact biodiversity and ecosystems (ESRS E4). This is an example of an inside-out impact—the effect your operations have on the environment.

However, you also face challenges due to climate change—the region where you farm is becoming hotter, and prolonged droughts are affecting your yields. This is an outside-in impact, as climate change is influencing your business operations (ESRS E1).

Both of these impacts, the one you create and the one you face, are material and need to be assessed as part of your double materiality analysis.

Steps for Conducting the Double Materiality Assessment

- Research Existing Media and Reports: Begin by gathering information from external sources such as news outlets, industry reports, or public statements about your company and the relevant sustainability topics. This will help you identify potential material issues, risks, and opportunities.

- Engage with Stakeholders: Stakeholder engagement is a crucial part of the double materiality assessment. This step involves talking to various stakeholders, both internal and external, such as employees, management, shareholders, customers, suppliers, regulators, and local communities. Through these discussions, you’ll identify what stakeholders believe are the material impacts of your business.

- Determine Impacts, Risks, and Opportunities (IROs): Based on your research and stakeholder feedback, assess the scope and scale of each identified impact, risk, or opportunity. Some issues may have a more significant effect than others, so it’s vital to evaluate each in terms of its potential impact on your business and its sustainability performance.

- Set Thresholds for Materiality: Not all identified IROs will be significant enough to report on. You’ll need to set thresholds to determine which issues are material to your company. Only those IROs that exceed the thresholds should be included in your final report.

- Document and Justify Your Decisions: Throughout the assessment, it’s essential to document everything—your research, the criteria you used, the conversations with stakeholders, and the thresholds you applied. This documentation will serve as evidence when you present your findings to auditors or regulators.

The Benefits of Double Materiality

The most significant advantage of conducting a double materiality assessment is that it allows you to focus on what matters most. If a particular topic is deemed not material, you won’t need to include it in your report. This reduces the number of datapoints you must track and report, potentially excluding a large portion of the 1,100 data points identified in the ESRS.

By focusing only on material issues, your sustainability report will be more relevant, concise, and credible, helping you meet the requirements of the CSRD while highlighting the most impactful aspects of your sustainability efforts.

Conclusion: Setting Yourself Up for Success

The double materiality assessment is the foundation of your CSRD report, and it is essential to get it right. By starting early and carefully documenting your processes, you’ll ensure that your sustainability report is both accurate and compliant with CSRD guidelines. In the next part of this series, we will explore the practical steps for compiling your report and how to align your data collection efforts with the final disclosures.

Remember, the key to a successful CSRD report lies in preparation. Start early, engage stakeholders, and focus on what truly matters to your company and its stakeholders.