Table of contents

Table of contents- GMROI: a key KPI in inventory management

- What is GMROI (Gross Margin Return on Investment)?

- How GMROI is calculated

- Practical example of GMROI calculation

- The role of GMROI in assortment management

- A practical example using Slim4’s GMROI functionality

- GMROI and strategic decision-making

- Conclusion

Overview

Managing inventory effectively requires more than simply tracking stock levels, it demands a clear understanding of how each product contributes to overall profitability. While businesses commonly monitor KPIs such as turnover, service level and excess stock, one powerful metric is still often overlooked: GMROI (Gross Margin Return on Investment). This indicator goes beyond volume and movement, revealing the true financial performance of inventory by linking margin, sales and stock investment. In this article, we explore what GMROI is, how it’s calculated and why it plays a crucial role in assortment decisions, supplier analysis and strategic planning.

What are the most important KPIs for measuring stock performance? The answer depends greatly on the sector, the business model and the company itself. Still, several indicators usually spring to mind: inventory turnover, service level, inventory days, excess stock… these are among the most common.

In this article, we want to go a step further and focus on a highly useful yet often underused KPI: GMROI.

What is GMROI (Gross Margin Return on Investment)?

GMROI, or Gross Margin Return on Investment, is an indicator that measures the profitability of inventory. Put simply, it shows how much gross profit is generated for every euro invested in stock.

For example, a GMROI of 1.5 means that for every euro invested in inventory, the company has generated €0.50 in gross margin. A value below 1 indicates that the inventory is not profitable, the margin does not cover the investment, resulting in losses.

GMROI is therefore a valuable metric for decision-making, especially in assortment management. It helps prioritise products, lines or categories according to their real profitability, optimise stock investment and identify both opportunities and issues within the catalogue.

How GMROI is calculated

GMROI is based on a simple formula that combines three essential variables for assessing inventory profitability: margin, forecast sales and available stock.

The general GMROI formula is:

GMROI = Gross Margin (%) × Stock Turnover

Where:

From this relationship, three key conclusions emerge:

- GMROI increases when the margin increases, meaning we are selling more profitable products.

- GMROI increases when forecast sales grow, as stock is converted into profit more quickly.

- GMROI decreases when available stock increases, since the capital tied up in inventory reduces return on investment.

Thus, this indicator not only measures inventory profitability but also highlights the factors influencing it: price, demand and stock levels.

Practical example of GMROI calculation

Let’s look at a numerical example. Imagine an item with the following data:

- Selling price: €0.1310

- Cost price: €0.0351

- Available stock: 31,600 units

- Total sales forecast (next 12 months): 210,231.96 units

1. Margin calculation

This means each unit sold generates a 73.2% gross margin on its cost.

2. Stock turnover

The stock turnover is therefore renewed 6.7 times per year.

3. GMROI calculation

GMROI = Margin x Turnover = 73.2 x 6.7 = 487

A GMROI of 487 indicates that every euro invested in inventory generates €4.87 in gross margin per year.

The role of GMROI in assortment management

In any business with a large product catalogue, not all items contribute equally. Some have high margins but slow rotation, others sell quickly but deliver low margins, others merely occupy space and capital without adding value.

Analysing GMROI, combining margin with turnover, allows a shift from a purely volumetric view to an economic view of inventory.

By multiplying the margin percentage by turnover, we obtain a score that helps determine stock policy and whether an item should remain in the assortment. Products with high margins and high turnover are always desirable. Conversely, items with low margins and low turnover may warrant discontinuation.

A practical example using Slim4’s GMROI functionality

Let’s explore the implications of GMROI in assortment management with a practical example in Slim4, our supply chain planning platform. Imagine that we want to analyse the performance of a supplier’s products and their contribution to the profit margin of each reference.

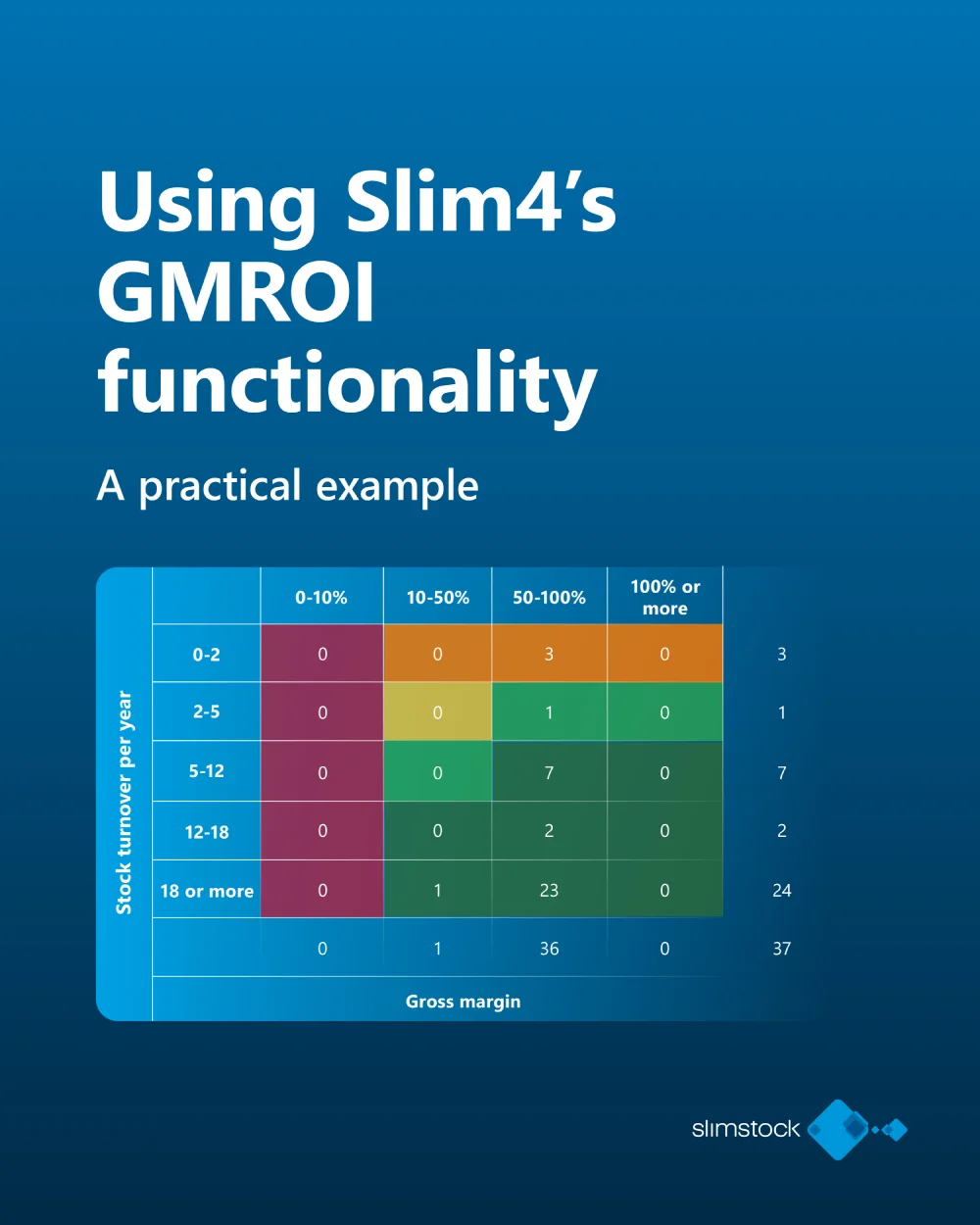

In Slim4, this is calculated using the GMROI functionality. The gross margin is equal to the selling price minus the purchase price, divided by the purchase price. In the example image, we have four gross margin segments: 0–10%, 10–50%, 50–100%, and over 100%. Turnover, on the other hand, indicates the average number of times an item is sold in one year, in this case: 0–2 times, 2–5 times, 5–12 times, 12–18 times, and more than 18 times.

Returning to our example, let’s assume the company we are analysing is a supplier for 37 of our references. What does GMROI tell us?

By multiplying the margin by the turnover, we obtain a score that helps guide decisions on whether or not to stock specific products. In this scenario, 34 of the references show good or excellent performance, meaning they should, in principle, have a guaranteed place in our assortment. However, three references display low performance, indicating the need for a more detailed analysis and, potentially, discontinuation.

Curious how GMROI can improve your own assortment? With Slimstock’s assortment management software, you can easily see which products are performing best, spot the ones that aren’t, and make smarter inventory decisions (without the guesswork).

GMROI and strategic decision-making

Beyond assortment analysis, GMROI is a key performance indicator that can inform broader business decisions.

For example, it can be used to review pricing policies, negotiate with suppliers, or redefine purchasing strategies. If a category shows excellent turnover but low GMROI, the margin may be insufficient. In such cases, it may be possible to renegotiate prices with the supplier or adjust pricing for the end customer.

GMROI is also valuable for evaluating campaigns or promotions. A commercial action that increases sales may appear successful at first glance, but if it reduces the unit margin to the point of lowering GMROI, its real impact on profitability could be negative.

Conclusion

GMROI remains an indicator that many companies are either unaware of or use superficially, despite its enormous potential. Few metrics connect three essential aspects of any business so clearly: stock, sales, and margin.

This is precisely its strength. By combining financial and operational perspectives, GMROI offers a complete picture of inventory performance.