We are probably all familiar with Schrödinger’s famous thought experiment, where he imagines a cat in a closed box with a flask of poison, which is broken at a random moment. According to Schrödinger, the cat is both dead and alive at the same time, until the box is opened, and the state of the cat is observed. The goal of his thought experiment is to illustrate the strangeness of quantum mechanics, where atoms exist in two states (superposition) until they are observed.

Although likely not intended by Schrödinger, it is also a perfect analogy for how inventory is perceived by different departments in business.

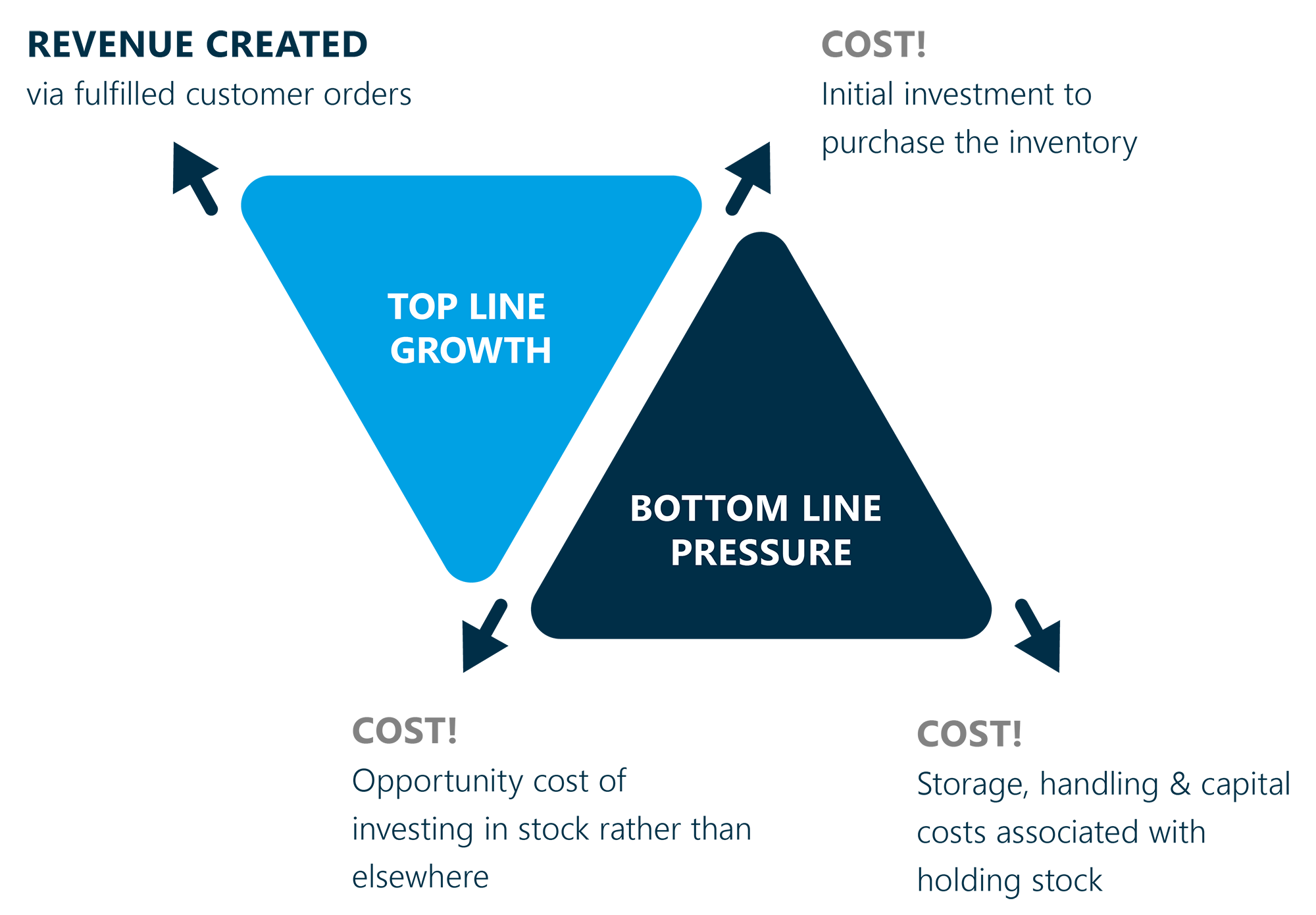

Inventory is in a unique position: until observed (let’s say at the end of our financial year), inventory is both sold (contributing to our top line) or sits in inventory indefinitely (increasing our cost, and decreasing our bottom line). So, is inventory a paradox?

Let’s explore this further. We’ll start by explaining what the top and bottom line are, and why (unlike many other costs) inventory has a major impact on both top and bottom line metrics. This explains the contentious nature of inventory level discussions that we all recognise from our S&OP meetings.

Lastly, we’ll look at solutions that will help us have better inventory to maximise both top line and bottom line metrics.

Top and bottom line

In supply chain, we don’t often talk about the top line and bottom line. These terms are more commonly used in finance and sales. In short, the top line of a business is our gross sales or revenue achieved within a certain timeframe. The bottom line is our net income, so our top line minus operating expenses, depreciation, interest and taxes.

In distribution, wholesale and retail organisations we create value through offering inventory when and where our customers need it. Therefore, we need inventory to make a sale. There is a direct relationship between inventory and sales.

On the other hand, when we decide to keep inventory, there is a cost of purchase. This cost of purchase by itself is fixed, but keeping inventory for a longer time period will increase the cost incurred by our business. The capital we invested in inventory could be used to buy products that do sell (opportunity costs), but the capital itself costs money (interest) and we incur costs for storage and insurance. These costs will decrease the bottom line results of our organisation.

The paradox called inventory

If we analyse all cost components of a supply chain (or business in general), we could argue that all of our infrastructure is required to fulfil customer demand.We need a distribution centre; we need trucks; we need labour; we need a production line.

Yes, we need to incur these costs to make a sale. There is however a difference when we compare these assets to inventory. All these elements of a supply chain are generic. Whether we use our supply chain infrastructure to ship Product A or Product B is (to a certain extent) irrelevant. Inventory is not: customers are typically looking for a specific product.

This is why inventory is such a contentious topic in our businesses. We cannot make a specific sale if we do not have it. But if we don’t sell it, our bottom line decreases due to it incurring operational and interest expenses.

Perception

We’ve written extensively about different departments that have a different perception of inventory. Our sales teams tend to see inventory as an opportunity to close a sale, whereas our finance department views it as a risk. More about those perceptions here. These perceptions align with inventory’s dual role in being converted to our top line and lowering our bottom line at the same time.

These different perspectives can lead to conflict if not managed well. Everyone in our company needs to understand the perspectives and the source of our perspectives. Our sales teams need to understand that inventory comes at a price, and we cannot simply buy more of everything. On the other hand, our finance department needs to realise that we cannot create revenue out of thin air.

S&OP as the silver bullet

Supply chain optimisation methods will help you acquire the right inventory that maximises sales while minimising costs. This is often achieved through better forecasting algorithms, better inventory models, economic order quantities, and other methods to control inventory levels.

However, people are still people, and fires still burn hot. This often leads to suboptimal decision making at both strategic and operational levels. A stockout might lead to a double buy, or high inventory may lead to sudden swings to the bottom line. Inventory optimisation can only do so much.

What we need is a platform that allows us to align on direction and discuss the constraints we face. Every decision has an impact and can be quantified as a trade-off between cost and revenue.

Sales & Operations Planning is this platform. Bringing different teams from sales, finance, and operations together to discuss planning allows us to share our different perspectives. By being curious about other departments’ high-level plans, and resolving constraints along the way, our organisations can stay away from panic and fire, and land on our feet.

After all, it was curiosity that killed Schrödinger’s cat.

FAQs

What impact does inventory have on a business’ top and bottom line?

Inventory directly affects both the top line, as it contributes to gross sales, and the bottom line, as holding inventory incurs costs.

Why is inventory often considered a paradoxical element?

Inventory is perceived as paradoxical because while essential for fulfilling customer demand and generating sales, its presence also imposes costs that can diminish a company’s bottom line if not managed efficiently.

What are the main costs associated with maintaining inventory, and how do they affect a company’s bottom line?

The main costs of maintaining inventory include purchase costs, storage expenses, opportunity costs, and interest on capital, all of which directly impact a company’s bottom line by reducing profitability through increased operational expenditures.

How do different departments perceive the importance of inventory?

Different departments within a company often perceive inventory differently; sales teams view it as an opportunity to close deals, while finance departments tend to see it as a risk due to associated costs, highlighting its dual role in impacting both revenue generation and cost management.