Table of contents

Table of contents- How to Overcome Your Bathroom Supply Chain Challenges

- 52% drop in consumer spending on home improvement

- Assessing the deep impact

- Margin

- Cashflow

- Missed opportunity

- Solutions

- Data-driven decision-making

- Better forecasting accuracy

- Responsive supply planning

- Optimised replenishment

- Adaptive scenario planning

- Results

- FAQs

The entire world has felt the pinch of the heightened cost of living recently. Almost no industry nor pocket of the globe has been safe from the collective tightening of belts.

And it’s not just consumers of luxury goods or high-end items; even those in the market for basic or everyday merchandise have been impacted quite severely.

In the bathroom industry, the cost-of-living crisis has had a major impact on the buying habits of its customers.

Home improvement tasks like bathroom upgrades have moved from necessary to luxury projects. This is shown by a hefty drop in consumer expenditure, with the home improvement industry seeing over a 50% consumer spending cut in the last 12 months (KBB FOCUS 2023).

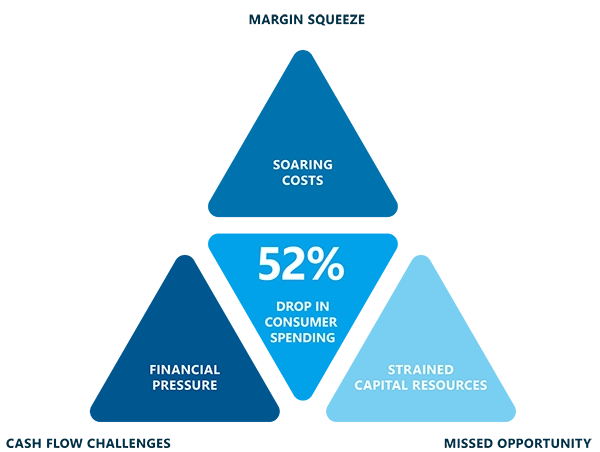

52% drop in consumer spending on home improvement

Make no mistake, this is a formidable challenge for the bathroom industry. With the cost of living crisis spanning across continents and industries, it’s hard to make a case for home improvements when even necessary items are being sacrificed.

There was a marked boom in the industry during COVID. Not only were people spending longer at home, looking at their out-of-date bathroom fittings far more, but alternative spending on things like holidays simply wasn’t possible.

As a result, the hot tap was turned on for the industry with a 250% rise in sales. Not only were homeowners spending more time in their own homes, they were spending more money on them too.

Now though, we’re facing the opposite market conditions. Whether you saw the writing on the bathroom mirror back then is irrelevant; the landscape has now shifted and the heat has left the room.

Businesses throughout the bathroom industry must now navigate the stormy market conditions to sustain growth and innovation.

Assessing the deep impact

If you’re in the bathroom industry, you’ll have seen the impact of the downturn in sales in a number of different ways. It’s not just that people are spending less money; it’s the way they spend the little money they do have, and how that affects your company.

Margin

Consumer pressure for cheaper deals and price reductions will have squeezed your revenues. This is the most obvious of side effects and will naturally impact your profits too.

Soaring costs for raw materials, labour and freight will have made things even tighter at the other end. Not only is there less revenue coming into the business, but the way you spend that revenue will be under the microscope.

Bathroom businesses like yours have been left with no choice but to fight to protect your already tight margins. It’s now every company for themselves.

Cashflow

A sharp decrease in revenue prompts cash flow issues. That’s common sense.

But a restricted availability of working capital places an even greater strain on the entire operation. All of a sudden, you’ll be looking at previously mandatory spending like marketing budgets and questioning their efficiency.

Whilst there’s a forced imperative to constantly evaluate money leaving the business, which can prove to be positive, it’s a simple truth that limited cash flow spells trouble.

And not just for the immediate health of the business.

Businesses that experience challenging financial situations often see stagnated growth and limited or no innovation.

And that can prove to be disastrous for the long-term success of the organisation.

Missed opportunity

Due to all the issues mentioned above, you’ve no doubt been grappling with a double-edged dilemma.

Where excessive inventory strains valuable capital resources, so too do stockouts translate into missed sales opportunities during peak spending periods.

Having the perfect amount of inventory in your warehouse will never have been more important. Similarly, working with suppliers who never let you down, increase costs or miss deliveries becomes crucial.

Will they shift their priority to those who have more orders on the horizon? Will you find it harder to continue your existing relationships?

Navigating the mess could be one of your hardest fights.

Solutions

Whilst it would be easy to panic and head for the hills, hope remains eternal with the right supply chain partner in place. And with a history of working with leading bathroom supply businesses through boom and bust, Slimstock has seen problems like this many times before.

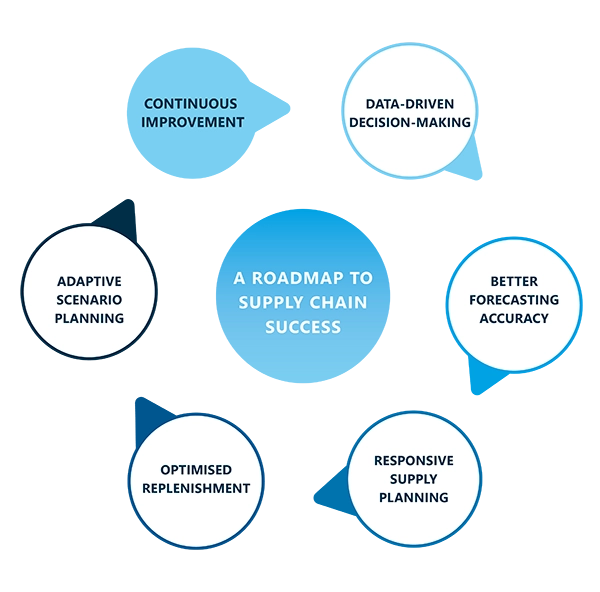

Data-driven decision-making

It’s absolutely imperative for you to avoid decision paralysis and to seize potentially missed opportunities. Making no decision is often worse than making the wrong decision.

It’s also crucial for you to have a mechanism in place for visualising KPIs. In times of trouble, transparency is a huge driver in navigating the turmoil. That goes for every single employee in your business, not just for those in the boardroom.

And you should also be able to track real-time performance metrics to bridge strategy and execution.

How well have the decisions you’ve made translated into business success? If you don’t know, it’ll prove borderline impossible to make successful decisions again next time.

Better forecasting accuracy

If you can eliminate the uncertainty surrounding your volatile demand, it will cease to become as volatile as it once seemed.

Knowledge is power. That’s as true in the supply chain industry as in any other.

Make sure you have a tool that utilises the most up-to-date technology in AI and machine learning for precise demand anticipation.

You should also make every attempt to gather insights from all departments to gain a unified view of future demand. This is a fundamental of an S&OP (Sales and Operation Planning) process, and doesn’t have to be left for just high-level planning projects.

Knowledge is power. Both up and down the chain of command within your business.

Responsive supply planning

Are you able to remove worries about supplier performance? As mentioned above, your suppliers have worries of their own. They’re more likely to give their time and effort to businesses that have higher order numbers and values.

If that’s you, great. But being responsive to the potential of it not being you is a smart move.

Evaluating current and future supply for swift responses to disruptions will mean you can future-proof upheaval almost before it arrives on your doorstep.

Use data insights to address discrepancies and to adapt to market changes. You already know there’s going to be more of them in the next 12 months.

The only constant is change. Data will help you spot that and be reactive to its impact.

Optimised replenishment

Fast, adaptive, low-touch replenishment will help you combat cash flow challenges. Can you automate replenishment for optimal product mix to minimise stockouts and excess?

Consider demand, promotions, events and scarcity to boost stock turnover and maximise your stock investment’s efficiency.

If you can limit, or eradicate entirely, your over commitment in stock, you’ll gain a higher agility in moving with the market.

Adaptive scenario planning

How can you curtail your fears around soaring costs?

By using advanced digital twinning to explore scenarios rapidly.

Making mistakes in real time, with real revenue, is a costly exercise you might find hard to recover from. Making them in a digital analysis will help you avoid them in real time … and in real life.

Analyse risks and opportunities the best way you can to enhance cost efficiency, protect margins, and boost supply chain performance.

Results

As mentioned above, Slimstock has years of experience in the bathroom industry. We’ve helped companies through every market condition possible, aligning their supply chain to the whims and occasional inertia of consumer spending.

Aqualisa, one of the UK’s leading bathroom manufacturers and distributors, recently embarked on a digital transformation journey to boost efficiency throughout its end-to-end supply chain.

Previously, they’d relied on a combination of their ERP system and spreadsheets to manage inventory. Many companies use these methods. Be it from legacy systems, management habits or tradition, they can be limited in helping you see through the steam.

For Aqualisa, as their business grew in complexity, they needed more insight for making effective inventory decisions.

And that’s when we opened the door, let the steam settle and guided them into a more secure future.

By adopting Slimstock’s award-winning supply chain planning platform, Slim4, Aqualisa optimised its supply chain processes to:

- Enhance visibility

- Improve collaboration

- Increase availability to 97% whilst maintaining stable inventory levels

Of course it’s not just Aqualisa. 1400+ of the world’s industry-leading bathroom brands rely on Slim4.

With the combination of our award-winning Slim4 platform and our dedicated global team of supply chain experts, we help them make better, faster supply chain decisions.

We help them maintain their status as industry-leading and world’s-best, biggest brands.

If you’d like to explore how we could do the same for you, click here to speak to a Slimstock expert.

FAQs

How does excessive inventory impact capital resources?

Excessive inventory ties up capital by using funds to purchase and store more goods than needed. This can lead to increased holding costs, reduced liquidity, and potential financial strain for a business.

How can data-driven decision-making help businesses in the bathroom industry?

Data-driven decision-making can help bathroom businesses by providing insights into customer demand, inventory management and market trends. This data can inform product development, optimise supply chains, and enhance marketing strategies, ultimately leading to better business outcomes.

Why is better forecasting accuracy crucial for overcoming volatility in demand?

Accurate forecasts enable companies to fine-tune inventory levels, production schedules and resource allocation, minimising the impact of demand uncertainty. This, in turn, improves overall efficiency, reduces costs, and enhances customer satisfaction by ensuring products are available when needed.

How does responsive supply planning help in addressing disruptions?

Responsive supply planning helps address disruptions by allowing businesses to quickly adapt to changes in demand, supply chain issues and/or unforeseen events. It enables swift adjustments in production, inventory levels and distribution to meet current market conditions.